Trending

4 Considerations To Craft Your Company’s Equity Strategy

/in Talent, Featured on Home, Equity & Compensation, Trending, I Need to Retain my Top Performers, Developing Your Team, Secondary Liquidity/by Matt McCueAdvancing Your Influence: Strategies for CFOs

/in Leadership & Vision, CFO Leadership, Developing Your Team, Featured on Home, Trending, Talent/by Matt McCueHow People Leaders Can Invest In Their Own Growth

/in Featured on Home, Trending, Talent, I Need to Retain my Top Performers, Developing Your Team, Leadership & Vision/by Matt McCueShare this entry

The CFO Software Stack

Most Used Business Systems & Tools by Private Company CFOs

Behind every growth-stage CFO is a robust software stack to help them track and manage business activities across the enterprise. When it comes to assembling a software stack, CFOs have hundreds of solution offerings to choose from, each with its own set of features, technical requirements, and implementation best practices.

CFOs can make better software stack purchases by learning from peers who have used the tools and systems they’re considering. That’s why we created The CFO Software Stack – an exclusive benchmarking survey and database for finance leaders in The Circle with ratings and reviews of 250+ unique software systems across 18 business activities.

Periodically, we convene as a community to review the latest data in the CFO Software and share best practices for evaluating and implementing software across key business activities.

Here are some highlights from those conversations:

What Software Does a CFO Use?

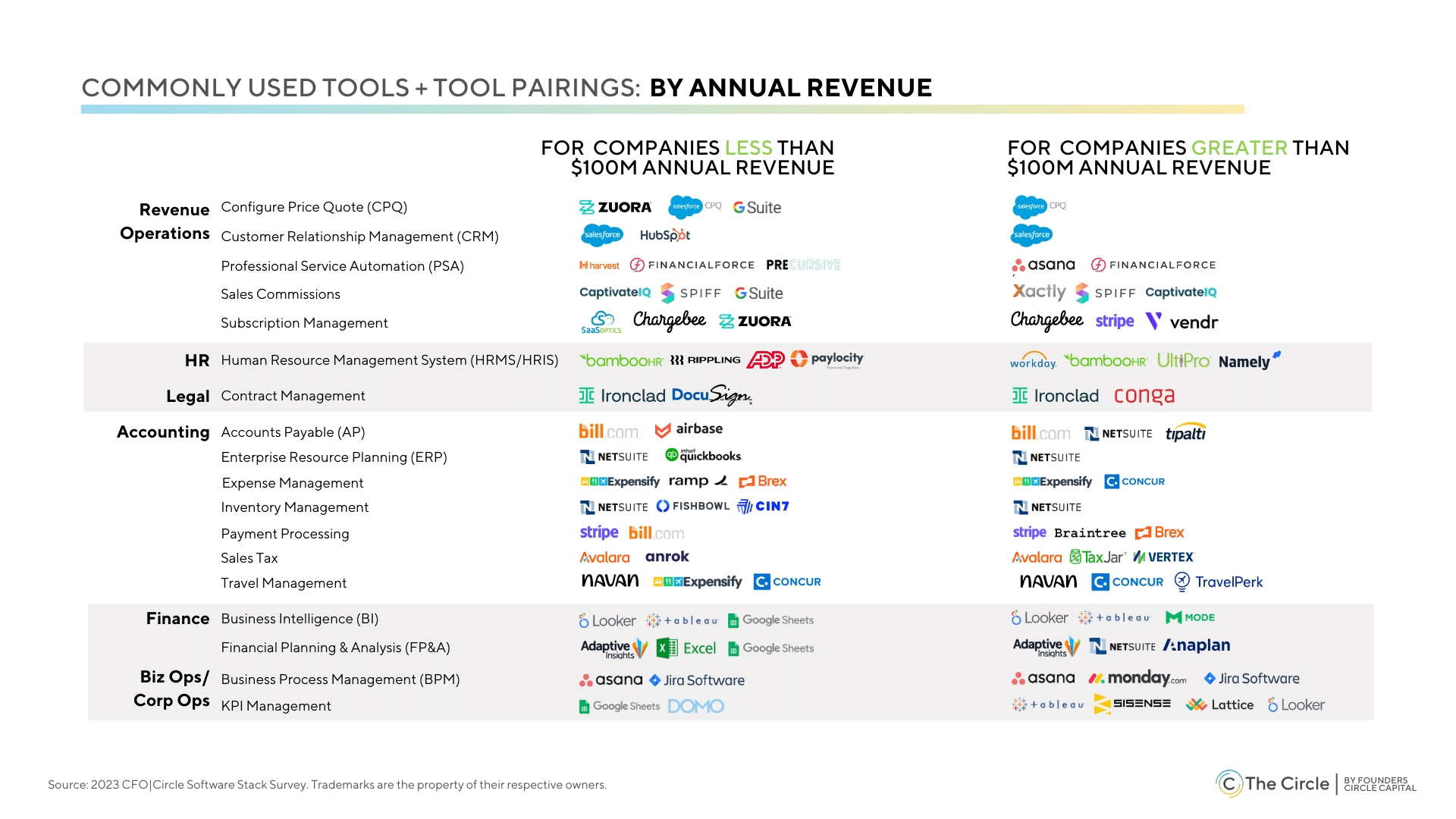

According to a 2023 survey of financial leaders in The Circle, here are the most popular solutions across 18 key business activities managed or supported by the CFO:

- Accounts Payable (AP): Bill.com, Netsuite, Airbase

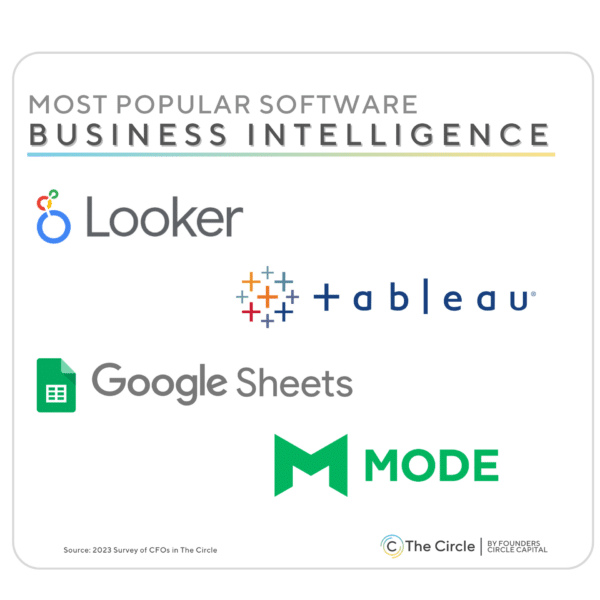

- Business Intelligence (BI): Looker, Tableau, Google Sheets

- Business Process Management (BPM): Asana, Jira, Monday.com

- Configure, Price, Quote (CPQ): Salesforce, Dealhub, Zuora

- Contract Management: Ironclad, Docusign, Conga

- Customer Relationship Management (CRM): Salesforce, Hubspot, Netsuite

- Enterprise Resource Planning (ERP): Netsuite, Quickbooks, Sage Intaact

- Expense Management: Expensify, Concur, Ramp

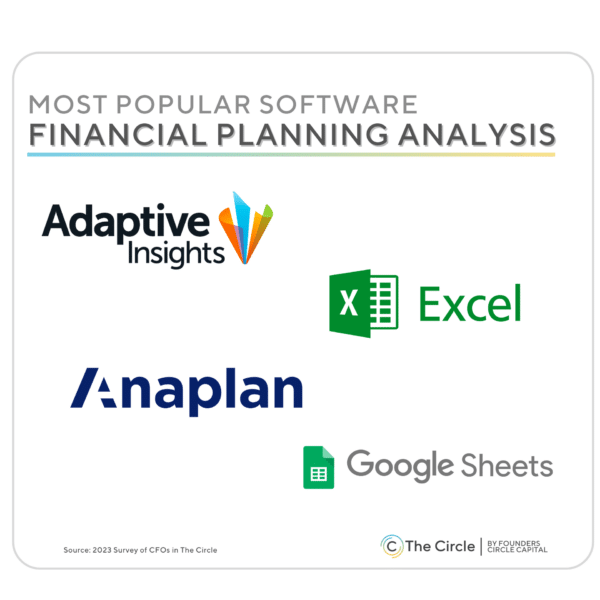

- Financial Planning & Analysis (FP&A): Adaptive Insights, Excel, Anaplan

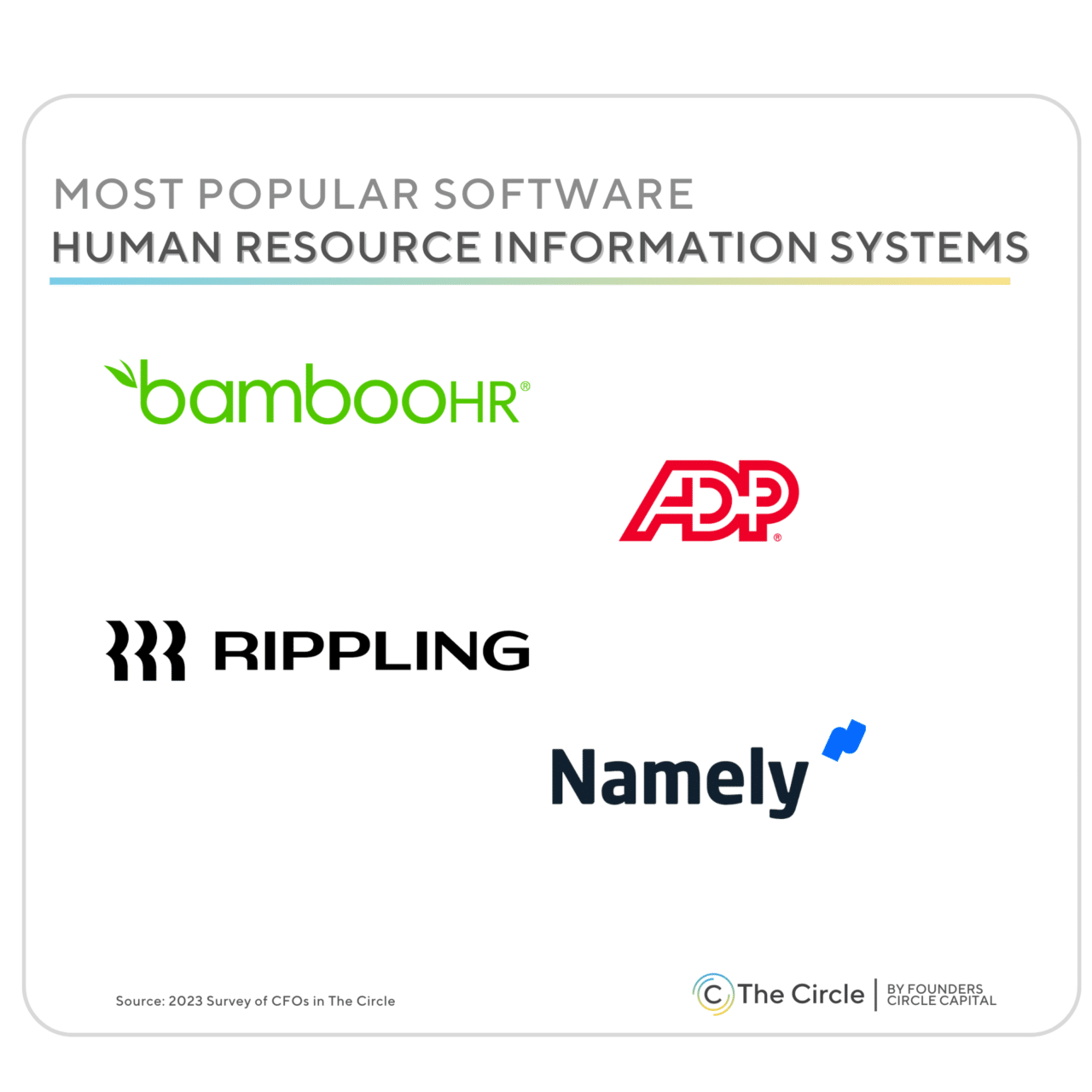

- Human Resource Management System (HRMS/HRIS): BambooHR, ADP, Rippling

- Inventory Management: Netsuite, Fishbowl, Cin7

- KPI Management: Google Sheets, Tableau, Looker

- Payment Processing: Stripe, Bill.com, Braintree

- Professional Service Automation (PSA): Asana, FinancialForce, Harvest

- Sales Commissions: CaptiveIQ, Spiff, Xactly

- Sales Tax: Avalara, Vertex, TaxJar

- Subscription Management: SaaSOtpics, Chargebee, Stripe

- Travel Management: Navan (formerly TripActions), Concur, Expensify

Naturally, a CFO’s software stack evolves as the company grows. The chart below illustrates how system and tool usage often diverges for companies below and above $100 million in annual revenue:

Whether you’re buying from a legacy provider or experimenting with a new solution, it’s important to ensure each system or tool can support the complexity of your business. As one CFO noted, “[providers] all seem to have the right capabilities and all the promise when you talk to them, but when you get down to actual implementation, you often realize they may not be robust enough for your business.”

Beyond pricing, another CFO pointed out that newer software and systems often have steeper learning curves, require more internal resources to manage, or only integrate with specific systems. These are all critical factors to consider during the vendor evaluation process, and it’s why more CFOs are using services like Vendr to compare providers and simplify the procurement process.

In reviewing the CFO Software Stack data with The Circle, we went deeper on five key business activities ranked highly by the community due to their complexity and importance:

Financial Planning & Analysis (FP&A)

FP&A systems allow companies to create budgets, forecasts, analyses, and reports for decision-making. While earlier-stage companies with smaller teams often get away with using spreadsheets to keep track of their analysis, they tend to need a more robust and automated system as the business and FP&A team scale. One CFO suggested implementing FP&A software once the headcount of your FP&A team reaches the mid-single digits, providing a centralized source of truth for multiple team members. They also advised that it’s worth implementing early “before it’s too late.”

Chloe Giraut-Pierron, Head of Finance at FP&A software provider Pigment, suggested four key considerations for CFOs when evaluating and implementing FP&A systems:

- Business Continuity – as employee retention becomes a growing concern, finding a system that can maintain financial model continuity when team members leave the organization or new members join is important.

- Model Flexibility – as your company and business model expands into new product lines or regions, your FP&A software needs to be flexible enough to adapt without a significant systems overhaul.

- Planning Cross-Collaboration – while FP&A sits within the Finance function, it often requires collaboration with HR, IT, Marketing, or Sales teams. CFOs will want to pay close attention to how their FP&A software facilitates cross-departmental collaboration to avoid lengthy and painful planning processes.

- Timeliness & Efficiency – CFOs often depend on access to real-time data in their financial planning, which is why they need software that integrates and synchronizes with existing IT systems. “This is often where I see companies decide to move to an enterprise performance management (EPM) system in order to gain greater efficiency in their FP&A processes,” said Chloe.

Most importantly, don’t underestimate the implementation process with FP&A software. Implementation can take months to several quarters and longer if you’re bringing in sales forecasts, revenue, P&L, etc. FP&A teams should own system management and dictate the level of functionality required, but keep in mind that team attrition can lead to longer implementation delays.

“It’s important to put your best team members on the FP&A implementation. Keep in mind that FP&A teams can experience high turnover, and if key members leave in the middle of an implementation, it can delay the launch timeline.” – Chloe Giraut-Pierron, Head of Finance at Pigment

Business Intelligence

Business Intelligence (BI) systems are another critical part of the CFO Software Stack that provides data warehousing, visualization, and dashboard tools that create a roadmap for the future. By investing in BI tools, finance teams can retrieve, analyze, and transform data into useful business insights for the strategic planning process.

More important than selecting the right BI tool is ensuring the business is fully ready to use it, said former CFO of Segment Sandy Smith. Leaders can make the mistake of investing in a BI tool too early or before there’s alignment on the business activities that the tool should be tracking.

“We all wish there was a BI tool that would magically fix any misalignment we have in our key data sets. In reality, for venture backed start-ups, BI tools wind up becoming a big forcing function to begin a dialogue on the important metrics and business definitions that should have already been in place.” – Sandy Smith, former CFO of Segment

Sandy recommends companies start as early as possible by defining and documenting the specific business definitions that support their strategic planning (which happens to be a key element of IPO Readiness). “Most firms have 10 definitions for revenue alone,” noted one CFO. Consider identifying internal stakeholders or forming a committee to track key business definitions across the business and ensure they align. Another CFO added that it’s important to establish clear roles and ownership of the BI software stack. “Even though Finance may be the biggest end-user of the firm’s BI tools, it should be clear who owns the data vs. the integrations, etc.,” she said.

Regardless of what BI system your company chooses, it’s best to start early and small with the implementation process, adding in new workflows slowly so as not to overwhelm the implementation team. Moving too quickly without the necessary functional expertise can create issues within the data and prompt employees to mistrust the data and resist the change. Ultimately, getting the CEO to engage in roadmapping the organizational structure of your systems will help avoid confusing negotiations across teams and align everyone towards a shared vision of the future.

Enterprise Resource Planning (ERP)

ERP systems are designed to automate business processes and provide insights and internal controls for many day-to-day activities. ERP software helps firms manage all the complex processes that affect their business, including accounting, procurement, project management, risk management, compliance, and supply chain operations.

While the ERP landscape is dominated by a handful of big players (75% of The CFO Software Stack respondents use either NetSuite or QuickBooks), lighter-weight ERP options are available. When evaluating an ERP provider, CFOs should ask these three questions:

- How will the system scale with the business? In all likelihood, business attributes such as your go-to-market motion or pricing model will not remain the same for an extended period of time, and your ERP needs to have the flexibility to grow and adapt alongside the firm.

- How well can it integrate? The ideal ERP system should be tightly integrated with the core business functions. “You want your ERP to talk to your financial planning, payroll, expense, and HRIS tools,” said Sandy. “It needs to be that single source of truth for your financial audits.”

- Can it Operate With Minimal Resources? An ERP should be easy to manage without a large dedicated team. CFOs recommended that ERP be owned and run by the Accounting team, which provides a different perspective on the data than the IT or Business Systems groups.

Human Resource Information Systems (HRMS/HRIS)

HRIS systems are used to oversee everything from recruitment to performance management and employee development. With an HRIS, a firm can map everyday processes to identify and eliminate bottlenecks, control costs, and ensure team effectiveness.

Like an ERP, an HRIS must be robust enough to scale as the company grows. By implementing a solid system early, an organization can avoid playing catch-up when adding more employees to their HRIS. Further, HR teams should own what metrics they’re looking to track with the HRIS, as the quality of reporting can vary from system to system.

Determining what data points will give you the best insight into your employee base will help you decide on an HRIS. Additionally, teams need to consider the payroll functionality of their HRIS systems and choose the system that best fits the company’s needs. For example, companies with international employees should implement an HRIS with international payroll abilities, as that function is not universal. In general, the community recommended that the HR team own the HRIS and generally have an operations person run the system itself.

Contract Management

An effective Contract Management System (CMS) helps to reduce the manual, low-value, repetitive work that comes with negotiating, amending, and analyzing legal contracts. With a CMS, business teams can use templates owned by legal to self-serve, agree on, and manage routine contracts at scale. A centralized repository of contracts makes it extremely easy for employees to tag and search for specific documents quickly, and automating these processes helps eliminate manual errors.

Many companies only implement an automated CMS management system after being overwhelmed by the sheer number and variety of contracts. The ideal CMS should integrate well with the systems that are the “main producers” of contracts, often the sales team. Finding a system that also provides data on contract speed and other relevant metrics offers teams insight into ways they can improve.

Generally, a CMS will be centralized within the Legal department as they have the most responsibility for contract compliance. However, CFOs in The Circle noted that either Finance or the Deal Desk might oversee CMS.

Tips for Software Stack Implementation

Beyond the vendor selection and negotiation process, implementation is one of the most critical parts of assembling a best-in-class software stack. Before investing time or money into evaluating a new software or system, revisiting these implementation best practices shared by Dave R Padmos and Kenneth Englund from EY’s IPO Readiness practice might be helpful.

Related Blog Posts

The “Art” of Annual Planning

The “Science” of Annual Planning