Trending

Top CFO Tactics for Reducing Software Spend & Consolidating Systems

/in I'm Looking for Strategic Planning Tips, Software Stack for Growth Companies, Systems & Processes, Trending, Featured on Home/by Matt McCue4 Considerations To Craft Your Company’s Equity Strategy

/in I Need to Retain my Top Performers, Secondary Liquidity, Developing Your Team, Talent, Trending, Equity & Compensation, Featured on Home/by Matt McCueAdvancing Your Influence: Strategies for CFOs

/in CFO Leadership, Leadership & Vision, Developing Your Team, Talent, Trending, Featured on Home/by Matt McCueShare this entry

Equity Compensation: When Startups Should Grant Restricted Stock, ISOs, NSOs, or RSUs

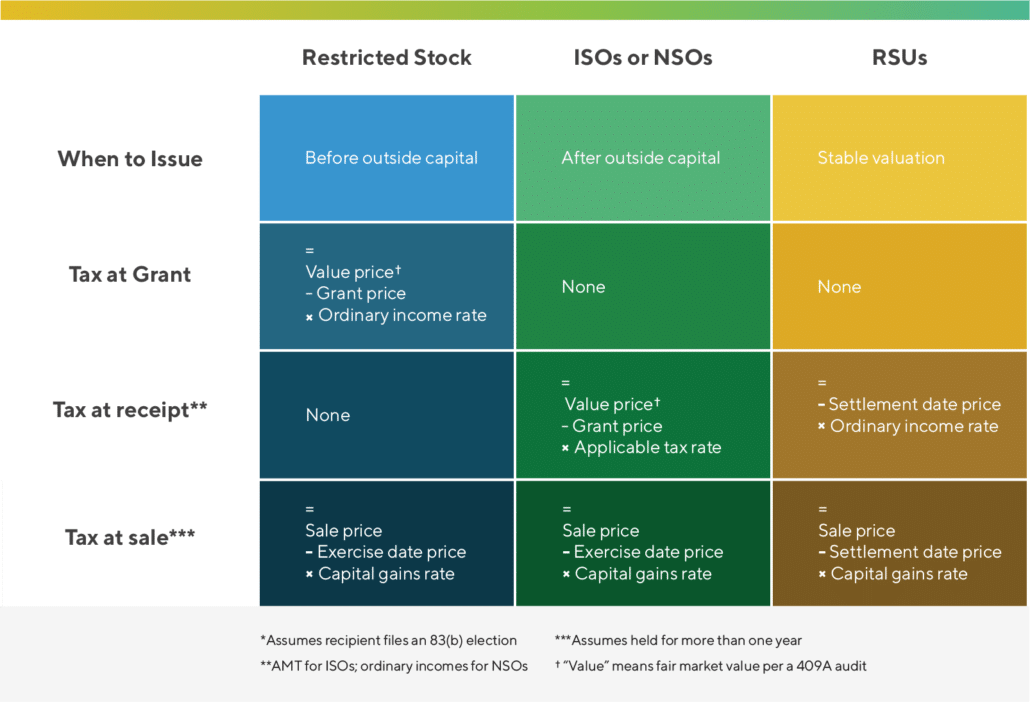

Figuring out how to manage what type of equity to issue—Restricted Stock, ISO, NSO, or RSU—is an ever-present challenge for startups, with the best strategy changing as a company grows. Equity compensation is a shifting and evolving target for startups, so determining how to value RSUs, or even if they are the correct equity option for your organization, will be an ongoing process.

Gunderson Dettmer, a Silicon Valley-based law firm that primarily represents venture-backed technology startups and emerging companies, has a

practice group dedicated to helping clients manage employee stock options in order to maximize both the ongoing incentives and the ultimate wealth creation for founders, employees, and shareholders.

We spoke recently to Ward Breeze, a partner who advises companies and investors on corporate and securities matters, and Lisa Gorrin, a partner

focused on executive compensation and employee benefits, to get their perspectives on how companies should think about equity compensation.

As a startup grows, they say, it should move from (1) granting restricted stock—actual company shares that vest as certain requirements are met; to (2) stock options that give employees the choice of buying company shares at a set price; and potentially to (3) restricted stock units that convert into actual company shares upon vesting.

And whether the employee attains liquidity before or after an IPO/M&A exit, there are tax obligations upon selling that they must be aware of and manage in order to maximize their personal wealth opportunity.

When in a startup’s life should it begin thinking about how it approaches equity?

Lisa: Right from the beginning. You should think about how you’re going to structure your equity, how much to give to founders and employees, how to get everyone the best tax treatment they can, and how to get equity in people’s hands with as little money coming out of their pockets as possible. It’s all about aligning incentives with the mission of the company.

When you give stock to someone who works for you, the value of the stock is taxable, assuming that stock is vested at grant or if unvested at grant, is the subject of an 83(b) election, just like if you give cash to someone who works for you. But when you give a person cash, some of that cash can be used to pay taxes. When you give someone stock, there’s no cash to pay the taxes.

In the early stages of a company, when it’s just an idea, without a product and without funding, stock generally has little value, so you can get it into people’s hands cheaply. If you give an employee stock without requiring the employee to pay for it, they’ll pay taxes based on the value of the stock, assuming they file an 83(b) election, but because the stock has little value, those taxes are going to be pretty minimal.

When the company grows, the stock’s value also grows, so granting restricted stock becomes more expensive for employees. Even though they may not have to come out of pocket to purchase the stock, they’ll still owe taxes. People either aren’t going to be able to or aren’t going to want to take the risk of paying taxes to get something that they still have to vest into (and that may or may not have value in the future). At that point – when the value of the stock is high enough that employees can’t or don’t want to use their own cash to pay the tax due when they receive the stock – it makes sense to switch to stock options — a choice to buy shares that aren’t taxable at the time they’re granted.

Stock options give recipients more choice and more flexibility, particularly with a company that has an uncertain future.

As companies grow, different types of equity compensation–restricted stock, ISOs, NSOs, RSUs–offer employees both wealth and tax obligations.

When should a company make that switch from restricted stock to stock options (ISOs/NSOs)?

Ward: It’s not always easy to know the answer to that question. One thing you can clearly point to is when a company has actually raised venture capital and sold preferred stock in a priced financing round. That’s when you’ve had some third party, that isn’t affiliated with the company, come in and say “we think a share of your stock is worth X dollars.” This is when we typically see companies begin issuing ISOs (incentive stock options) or NSOs (non-qualified stock options).

Sometimes, though, even if you’ve had a financing but are early in a company’s life cycle when valuations are low, you may still be willing to grant restricted stock, as opposed to options, at a steep discount to the preferred-stock price under the theory that the company doesn’t really have a product or revenue. Even though the early financial backers might have put in, say, $500,000 for 20% of the company, you might still feel comfortable giving an early employee restricted stock, not valuing the company at $2.5 million but maybe valuing the company at $25,000—the theory being that if you wound the company up immediately after that financing, the entire value of the business would go to the preferred holder, and the common stock is relatively worthless.

These decisions are very nuanced and fact-dependent, so you have to be careful to look at the specifics of the company and its position at the time and get advice on this point.

What are the pluses and minuses of stock options?

Lisa: When you grant stock options to employees, there are no taxes on the options at the time of grant. If the employee holds onto the stock options and doesn’t exercise them, she doesn’t have to come out of pocket for anything so she really has no risk, in terms of the company going down in value. If the employee leaves the company, typically the employee has to decide whether or not to exercise the vested stock options within a pretty short period of time after employment ends or they’ll be forfeited. Exercising stock options does involve some risk, because it requires cash to buy the shares and, in some cases, to pay the tax based on the difference between the value of the stock at the time of exercise (often based on a 409A valuation) and the exercise price.

Still, the stock option gives an employee a lot of flexibility to choose whether she wants to reduce her risk. She can either hold on to the stock options, not exercise them and just wait for an exit event to simultaneously exercise and sell her shares, or, she can exercise her stock options at any time before an eventual exit to try to get into a better tax treatment where she might possibly yield higher gains if the company has a successful exit event.

The Tax Cuts and Jobs Act (TCJA) of 2017 added a few major perks for investors looking for long-term wealth management. The increase in phase -out thresholds and the exemption amount for the Retained Alternative Minimum Tax (AMT) means fewer people will likely face major AMT charges. For founders and startup investors, the TCJA may affect when they might want to exercise your ISO’s—and whether or not they might be able to convert them without substantial AMT payouts. They’ll also want their financial planner to explain how the new law lowers taxes for certain types of C-corporations, S-corporations, and LLCs; the TCJA has dropped the corporate tax rate from 35% to 21%.

What are the tax implications of her choices?

Lisa: The tax consequences vary depending on the type of option that the employee holds and can be pretty complex. At a high level, if she holds the stock options until an exit and immediately exercises and sells the stock, either in the public market or to the buyer in an M&A transaction, she’ll owe tax on the difference between the value of the stock and her exercise price. She’ll be taxed at a rate equal to her ordinary income tax rate on the entire sale, which means a higher tax obligation for her.

On the other hand, if she exercised her stock options before the exit, she may be able to pay lower taxes if all goes as she hopes. If the value of the stock is greater than her exercise price when she exercises, she may owe tax on that gain, depending on the type of option she holds and her own personal tax circumstances. Then, if she satisfies certain holding periods – which vary depending on the type of option – once the shares are ultimately sold, she’ll be taxed at the long-term capital gains rate. If the value of the stock increased over time and she was able to sell at a gain, this all means an overall lower tax obligation for her.

By exercising and trying to pay less in taxes and ultimately make more money, the employee is taking on risk though. If things don’t go as she hopes, she may lose some or all of the money she pays to exercise, including taxes, so anyone thinking of exercising should dive deeper into the tax consequences of his or her options specifically, the company’s prospects and his or her own financial situation before exercising.

I should also add that tax laws are always subject to change – as I’m sure you know, they changed quite a lot in recent years – so the tax rates or even the overall structure I just described could change in the future, but that’s the state of play now.

Ward: As Lisa said, the IRS taxes you when you exercise. That can be a big pain in the neck at really highly valued companies. Let’s say they had options for 10,000 shares at a dollar a share. Maybe an employee could come up with $10,000 to buy his stock. What he couldn’t do is come up with the money to pay the taxes on $4 million worth of income if the company has shot up in value and is now worth 400 times what it was when his option was granted.

It sounds like you’re describing another inflection point in a company’s life. When do stock options no longer make sense?

Ward: Let’s say a company has a run-up in value. The company goes from its early valuations of $5 million to $30 million to $120 million to $700 million, as we have seen happen a bunch of times.

If a company’s value starts to flatten—from $700 million to $750 million—the incentivizing effect of options is muted. At these higher valuations, companies start to think about alternatives like RSUs (restricted stock units).

With a restricted stock unit, the employee doesn’t own any property. You just have the right to receive the value of a share of stock upon the occurrence of certain events.

It’s a derivative instrument, unlike restricted stock, so it has less advantaged tax treatment. With restricted stock, you own the stock outright and if you met the statutory holding periods when you sell the stock, you get long-term capital gains treatment on the gain. With an RSU, on the other hand, you’re not eligible to receive long-term capital gains treatment based on when the RSU was granted because you don’t own stock when the RSU is granted. You only receive stock and start your holding period for long-term capital gains purposes when the RSU vests.

Lisa: An RSU is really a promise for an employee to get a share of stock (or sometimes, its cash value) in the future. Although they’re the least tax-advantaged form of equity comp we’re talking about today, they can be attractive in later-stage companies because they don’t have an exercise price or purchase price and also don’t have any upfront tax consequences.

RSUs have been around for a long time in public companies, and in a public company, they typically just have time or service-based vesting. When you’ve worked for the company for a year, 25% of your RSUs might vest, and you would get a certain number of shares of stock at settlement. Like I said before, when you get shares of stock from your employer, you owe tax on that.

In a public company, when your RSUs vest and you get a tax bill, you just go ahead and sell some of the shares that you just got in the public market, and use the cash you’re paid from the buyer to pay your taxes. In a private company, that doesn’t work because there’s no market for those shares. If your RSU were to vest while the company is private, you couldn’t easily sell shares to cover your taxes and you couldn’t plan ahead to set aside money for taxes because you don’t know what those taxes will be. Your taxes will be based on the value when the RSUs vest and are converted into shares that you own. So when those RSUs are granted to you today, maybe the company is worth $100 million.

When they vest and settle a year from now, it might be worth $150 million but you won’t know that in advance, so you can’t prepare for the tax bill.

One way private companies have gotten around this problem is to require an exit event for the RSUs to vest. That way the employee isn’t taxed until she can sell shares, or the shares otherwise become liquid, to cover the taxes.

That structure—using RSUs that require an exit before vesting—seems to protect employees in a way that options don’t, particularly if they leave the company. Why isn’t it more popular?

Ward: A lot of these structures work really, really well for public companies, but don’t work as well for private companies.

Part of the problem with RSUs is that, unless there is, in IRS speak, a “substantial risk of forfeiture,” then the transfer of the RSUs would be deemed taxable at the time they’re granted to the recipient, even though there are vesting conditions.

If that’s the case, and I give you 10,000 RSUs that are worth $200,000, now you’ve got an immediate tax impact. So how do we get around that? There has to be a substantial risk of forfeiture.

The workaround we use and which accounting firms have gotten comfortable with that won’t blow your tax treatment is having an expiration date on the RSUs. This is something you’ll want advice on from your accountants, but we generally see RSUs with a life of around seven years.

Because of this limited lifespan, if you give RSUs at an early stage of the company’s life, where it’s not at all clear that you’ll get to an exit before the RSU expires, you’re essentially giving the employees nothing at all because if you don’t get to an exit before the RSU expires, in order to comply with the IRS rules, the whole thing will just evaporate.

Lisa: And because there is no concept of exercising RSUs, the employee can’t do anything to avoid losing the RSU when it expires, if it hasn’t vested before the expiration date. Also, unlike options, which allow employees to decide when to exercise, RSUs give the employee no choice about when the event will happen that triggers taxes. That difference takes away the employee’s ability to do some tax planning, which some employees, particularly executives, might want to do to maximize their income from the equity.

And because RSUs are just a promise to give someone the value of a share of stock in the future, someone who holds RSUs can’t participate in secondary transactions, like an employee tender offer or a one-off sale of stock before an exit event. On the other hand, if a company wants to limit secondary trading in its stock, it can do that by issuing RSUs, which aren’t transferable and don’t convert into stock until a liquidity event.

You mentioned an 83(b) election before. What is that?

Ward: Under the normal IRS rule, when you get restricted stock, and it’s subject to vesting, the IRS will say, “OK, fine, no tax today, but we’re going to tax you when it vests on the value of the stock at the time it vests.”

An 83(b) election essentially says, “Hey, IRS, I’ve gotten this property. It’s subject to vesting but ignore that vesting. Instead, tax me now on the difference between the price I paid and its fair value.”

If you pay fair market value to buy your stock, lo and behold, those two numbers are the same, and you’re taxed now on the entirety of the grant. X minus X is zero, so fair-market value minus the price I paid is zero. The tax on zero is zero. Because you’ve paid fair market value for the stock and filed an 83(b) election, you don’t have to worry about paying tax on the increase in value as you vest in the security.

If the company gave you the stock and you didn’t pay anything to get it, by filing the 83(b) election, you would still be saying, “Tax me now, IRS.” Like I said, the tax would be ordinary income tax on the difference between the price you paid – zero in this example – and the value of the stock. In other words, if you pay nothing for the stock and file an 83(b) election, you’ll be taxed on the value of the stock when it is granted to you. Because you’ve filed an 83(b) election and paid tax on the value of the stock, just like in the other example of the 83(b) election, you don’t owe taxes on the increase in value as the stock vests.

For a startup, that’s incredibly valuable because, if you’ve got stock that vested over a four- or five-year period, the increase in value over that period in a startup can be incredible.

In order to avoid that, you file your 83(b) election at the outset as soon as you get the stock. It has to be done within 30 days of the receipt of the stock, and then no more taxes until you sell the stock. That 30-day deadline is very strict though. The IRS doesn’t make exceptions if you miss it, so don’t mess that up.

The 83(b) election isn’t something that you recommend everybody do?

Ward: In a public company, where you can sell shares to get cash to pay your taxes even if the value of the stock goes up by the time the shares vest, I would say you probably shouldn’t file an 83(b). It doesn’t make sense unless you are 100% confident that the price is only going to go up in the future and that you aren’t going to leave and forfeit the shares.

In a private company, it really depends on the value of the stock, where you think the company is going, and your own personal financial situation. If the company has just been formed and the stock has hardly any value, it’s generally worth filing an 83(b) election, because, even if things don’t go well, you don’t have a lot to lose. If the stock has some value to it though, you need to examine your own finances and whether the risk of paying tax on something that you could lose completely if you don’t vest in it or that could go down in value is worth the potential future reward of perhaps paying less in taxes.

Keep in mind, if you receive restricted stock in a private company and don’t file the election, you’re committing to paying taxes in the future in an unknown amount and you won’t be getting cash to pay those taxes when they come due. That is just an uncomfortable place to be. To go back to the idea of when it’s time to switch from granting stock to granting options, if an employee isn’t comfortable with filing an 83(b) election and paying tax up front and isn’t comfortable committing to paying taxes as the shares vest, because he doesn’t know how big that tax might be, then that employee should probably receive options instead.

Related Blog Posts

4 Considerations To Craft Your Company’s Equity Strategy

Evolving Your Compensation Plan on the Road to IPO