Table of Contents

- Understanding the CFO Role

- Hiring the Right CFO

- Setting the CFO Up for Success

- Final Thoughts

Share this entry

The CFO Hiring Playbook

A Guide to Hiring a Finance Leader to Drive Transformational Growth at Your Organization

The CFO is the bleeding heart of an organization. Far beyond their role as the head of the finance function, CFOs are instrumental in steering and recalibrating the company’s growth strategy and building bridges that connect activities across the organization to a shared set of targeted financial outcomes. In times of volatility or as a company approaches major growth milestones like a fundraise, liquidity event, or IPO, CEOs often lean heavily on their CFO to be their strategic partner, confidante, problem-solver, and data-driven storyteller for the business.

Needless to say, CFO is an important job that only grows in complexity and influence as a company scales. At every stage of growth, CEOs need to be asking themselves if they have the right CFO to tackle the challenges of today, next quarter, or the next 3-5 years. At the same time, CEOs need to empower their CFO with the trust, resources, responsibilities, and relationships they need to effectively do their job.

A big part of success in the CFO hiring process is knowing who to look for. Over the years we’ve gotten to know and learn from some tremendous finance leaders within The Circle community including the six leaders featured in this CFO Hiring Playbook. Inside this playbook are firsthand insights on what the CFO role entails, the qualities needed to perform the job well, and how the role evolves at each stage of growth. Our hope is that this playbook gives founders and CEOs a better understanding of when to hire a CFO, who to look for based on the needs of their business, and some tactical approaches to identifying and successfully onboarding the right candidate.

When you’re done reading with this playbook, be sure to explore the other C-level titles in our Hiring Playbook Series.

The Role of a CFO

At the highest level, a CFO is responsible for overseeing an organization’s financial health and direction. This charter can involve a broad spectrum of duties and responsibilities, depending on the size and nature of the company; however, a CFO needs to be keyed in on three elements of the business operation:

Financial Planning & Accounting (FP&A)

Managing the financial model and overseeing the analytical, forecasting, and budgeting activities that support the health of the business.

Risk Management

Identifying and mitigating financial risks to the business model or that prevent the company from delivering against expectations.

Systems and Infrastructure

Implementing tools, processes, and systems that improve financial performance and accuracy.

Alongside managing the business’ financial operations, CFOs partner closely with the CEO on long-term growth objectives, whether fundraising, revenue strategy, business, or headcount expansion. The CFO’s job isn’t just to run the numbers behind the financial model but to analyze and incrementally improve decision-making across the business.

Caleb Hill, CFO of Codat, explains the outsized role a CFO plays within an organization:

Caleb highlights two important aspects of the CFO role that CEOs should know going into the hiring process. First, a true CFO isn’t just the “numbers person.” CFOs neither want to be nor are used most effectively when buried in spreadsheets or fixating on the financial aspect of the business; in fact, if they’re doing that, they’re missing important connections between how business activities are impacting long-term growth. Second, CFOs are integrated thought partners who share resources with every functional leader in the organization. While the CEO-CFO dynamic is critical (and we’ll dive plenty into that later in this playbook), the CFO also needs to be someone who is trusted by and invested in the success of every leader in the C-suite.

Perhaps the most important (and hardest) part of a CFO’s job is navigating and managing the company through change. In their never-ending pursuit of financial stability and predictability, CFOs have to bring a measured, data-driven response to external uncertainty. While everyone else is focused on their functional area of the business, the CFO has to be the one to stare reality in the face and lead the response across the organization – they are the person that everyone in the company looks to decide how the business is going to evolve and adapt to change.

In short, when you’re planning to bring on your first CFO it’s important to think of that person not just as a finance leader but rather a powerful investment in sustainable growth.

5 Signs You Should Hire a CFO

Like other C-level positions, the timing of a CFO hire really depends on your company’s financial needs, growth targets, and hiring budget. Most companies start looking for a CFO at or around the growth stage (Series B+) or when there is a clear product-market fit for the business’s core product. If a CFO is brought in too early, they may not have the tools or resources to scale the business to the next level of growth. At the same time, great CFO candidates - the kind that can really deliver outsized impact across the organization - tend to be attracted to companies with a strong or potentially strong growth trajectory.

Aside from the growth milestones, often there are clear signs for when a CFO becomes a necessary hire for the organization - our experts highlighted five common ones:

Rapid Business Growth

Companies on a high growth trajectory will need someone to build a sound financial infrastructure to sustain that growth. Without that leader, the company risks not having in place the systems and controls to measure financial performance, manage cashflow and capital, and mitigate risk. A high-growth CFO can come in and quickly identify the key problem areas that need to be solved and assemble a team that’s going to scale the finance function to where it needs to be.

Unpredictable Growth

A CFO needs to be brought in when growth seems uncertain or unpredictable. If you’re looking back two or three quarters and seeing a wide variance in business KPIs like acquisition cost or customer lifetime value (LTV), you need a CFO who’s going to get the bottom of why that is. A CFO might not be able to drive predictive growth immediately, but they’re at least going to build the foundation and chart the right path toward that outcome.

Fundraising or Expansion on the Horizon

A capital raise, acquisition, or expansion into a new market or territory may be a perfect opportunity to bring on an experienced CFO who can provide guidance on some of the risks and strategic considerations. At the same time, having a great CFO on board will send a strong signal to the board and prospective investors that the company is thinking long-term about its growth trajectory.

Your Finance Function Could Use a Facelift

The most obvious sign you need a CFO is when the financial operations of the company are in disarray: data is being stored in disparate places, there’s no consistency or transparency in how leaders are reporting on performance - all of that starts to slow a company down as it gets to growth stage. Fairly quickly, a CFO should be able to diagnose what systems and software are missing, who needs to be hired, and how to overhaul business and accounting processes to get the financial operations up to par.

CEO’s Time is Better Spent Elsewhere

Some CEOs love being close to the numbers but don’t have the time to make it a significant part of their job. When the CEO is spending too much time in the financial model, preventing them from using their time for more accretive tasks, it’s time to bring in a dedicated finance leader with a C-level title.

5 Qualities to Look for in a Great CFO Candidate

Every CFO is going to bring a unique perspective, skillset, and resume of experience. CFOs typically come from an accounting, investment banking, or operations background, and the right background to index for will depend on the size and nature of your business (more on that in the next section).

It’s also important to distinguish between CFOs who are “builders” – they enjoy the challenge of building the finance function from the ground up – versus “growers” who specialize in helping the company scale to the next level of growth. Regardless of whether you need a builder or grower, you ideally want someone who has firsthand experience in the areas that are most directly impacting business outcomes, Couchbase CFO Greg Henry explains:

Then, of course, there are the intangible qualities that make a CFO “great” – our experts shared the qualities they believe are most important to look for in a CFO candidate:

#1 Financial Discipline

Despite having a cross-functional role, the CFO’s job first and foremost is to own the company financials. Therefore, a CFO candidate needs to be someone who demonstrates a high level of financial discipline. They recognize the importance of high-fidelity financial reporting where every number is traceable back to its origin, as well as establishing a robust set of controls that maintain a firm level of transparency. Most importantly, the CFO’s financial discipline sets the tone for how the rest of the organization analyzes and reports on their functional areas with integrity.

#2 Data-Driven

While every CFO relies on data, not every leader is willing to follow through on tough decisions based on that data. Companies need a CFO who is not only data-obsessed but also proactive in mining that data for issues that they can then bring to the leadership team, even if it leads to some difficult conversations. Corley Hughes, CFO of Sondermind, explains:

#3 Forward-Thinking

CFOs spend a lot of time analyzing historical financial performance, but the great ones also stay focused on long-term strategic planning. They’re adept at understanding the factors that could contribute to or inhibit organizational growth and they’re able to scenario plan around how the next few quarters (or years) could play out. At the same time, great CFOs are sounding boards and thought partners to the CEO as they think about the next level of growth for the business.

#4 Flexible Problem-Solver

CFOs are constantly thinking (or worrying) about the health and runway of the business. When times are tough, or when there’s uncertainty in the balance sheet, it’s easy for a CFO to slash budgets or tell everyone to pull back on major growth initiatives. But instead of being a CF”NO”, a great leader is going to go the extra mile to try and find creative solutions that don’t stifle growth or momentum. Your CFO needs to be agile in their approach to problem-solving, always focused on continuously improving results regardless of external conditions.

#5 Relationship-Builder

Great CFOs rely on strong relationships with the rest of the C-suite to drive the growth they’re chasing. Your CFO should be someone who sees themself as a partner to the rest of the organization, not necessarily the “enforcer” that says no or tries to mitigate risk at every turn. They also need to be focused on building relationships outside of the walls of the business, including with the board, investors, and even customers.

Do You Need a VP/Head of Finance or CFO?

In the early stages of growth, companies might use a fractional CFO or have a VP or Head of Finance who can handle many of the duties of a traditional CFO. Certainly, this approach makes sense if you have an exceptional leader with the right level of financial expertise, strategic thinking, and decision-making authority. Eventually, in an organization that has both titles, it is generally understood that the VP of Finance will assume more of the day-to-day financial operations while the CFO focuses on big-picture strategy and longer-term initiatives.

The right title designation is going to depend on the breadth of experience of the person you’re hiring (or up-leveling) and the expectations placed upon them. If you’re going with the CFO designation, that individual should be ready to take on executive-level responsibilities, such as:

- Engaging with the Board – CFOs spend a good portion of their time presenting to and planning alongside the Board. Your finance leader needs to be comfortable forming board relationships and potentially managing the board more closely during times of volatility.

- Long-term Strategic Planning: CFOs are expected to help shape the direction of the company. It’s important to have a finance leader who shows a willingness to work closely with other members of the executive team and to get intimately involved in other areas of the business. For later-stage companies, the CFO is often expected to lead the multi-year IPO readiness effort.

- Scaling the Finance Function: CFOs should expect to remove themselves from most, if not all, of the day-to-day financial and accounting operations once they have a competent team of functional leaders. Needless to say, your CFO needs to be comfortable building and managing teams at scale, creating a culture for the finance organization.

Hopefully, you have a sense of why a CFO is a must-hire and the general profile of a CFO candidate that you should look for. In the next section, we’ll dive deeper into the specific qualities and job responsibilities of a CFO at three pivotal stages of company growth.

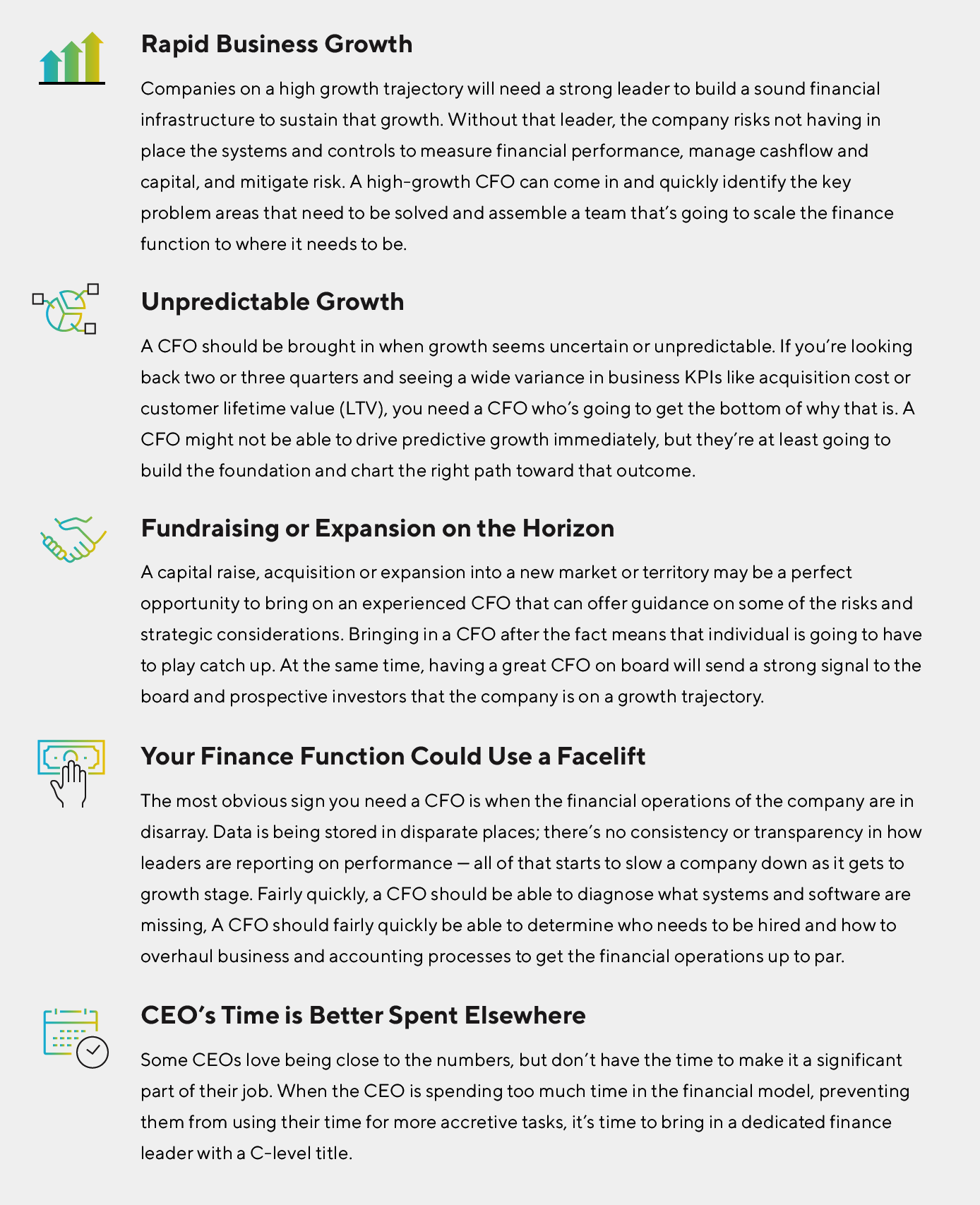

What They Do:

- Oversee all financial and accounting operations and other areas that overlap with finance (i.e., IT/Infrastructure or Legal)

- Support the CEO in growth initiatives

- Build a growth plan for the next 1-3 years that factors in the GTM strategy, headcount needs, and potential fundraising

- Start building the foundations for financial systems and controls

- Help the CEO build board decks and financial reports.

Typically Hired When:

- Company is at Seed or Series A+ financing with recurring revenue

- Company has Controller or fractional CFO, or the CEO oversees finance themselves

- CEO wants to offload the finance function to a full-time hire

In the GTM phase, a finance leader will put the building blocks of the company’s financial operations in place. This individual might carry the CFO title, but more likely, they’ll be a VP or Head of Finance or Strategy. While their primary focus will be on taking ownership of and building out the finance function, a leader at this stage of growth can also be leveraged to support multiple aspects of the business.

Michael Golub, VP of Finance & Strategy at Pano AI describes his role as maximizing growth across the business:

Who to Look for:

Someone with financial expertise or an operations background.

Someone who has worked at a startup or is comfortable rolling up their sleeves with a lean team and resources.

Someone with domain expertise in your organization’s biggest problem area. For example, a direct-to-consumer company might benefit from a leader with supply chain or sales experience..

Questions to Ask During the Interview:

- Tell me about the financial vision of a company you’ve worked at. How did you contribute to achieving that vision and is there anything you wish you could have done differently?

- Tell me about your relationship with your CEO at your last job. How frequently did you meet, what was the nature of those conversations, and how did you navigate conflict?

- If you joined the company tomorrow, what are the first five things you’d want to understand to help you create the financial roadmap?

- Walk me through a theoretical process for how you might grow a company like ours from $5 million to $50 million.

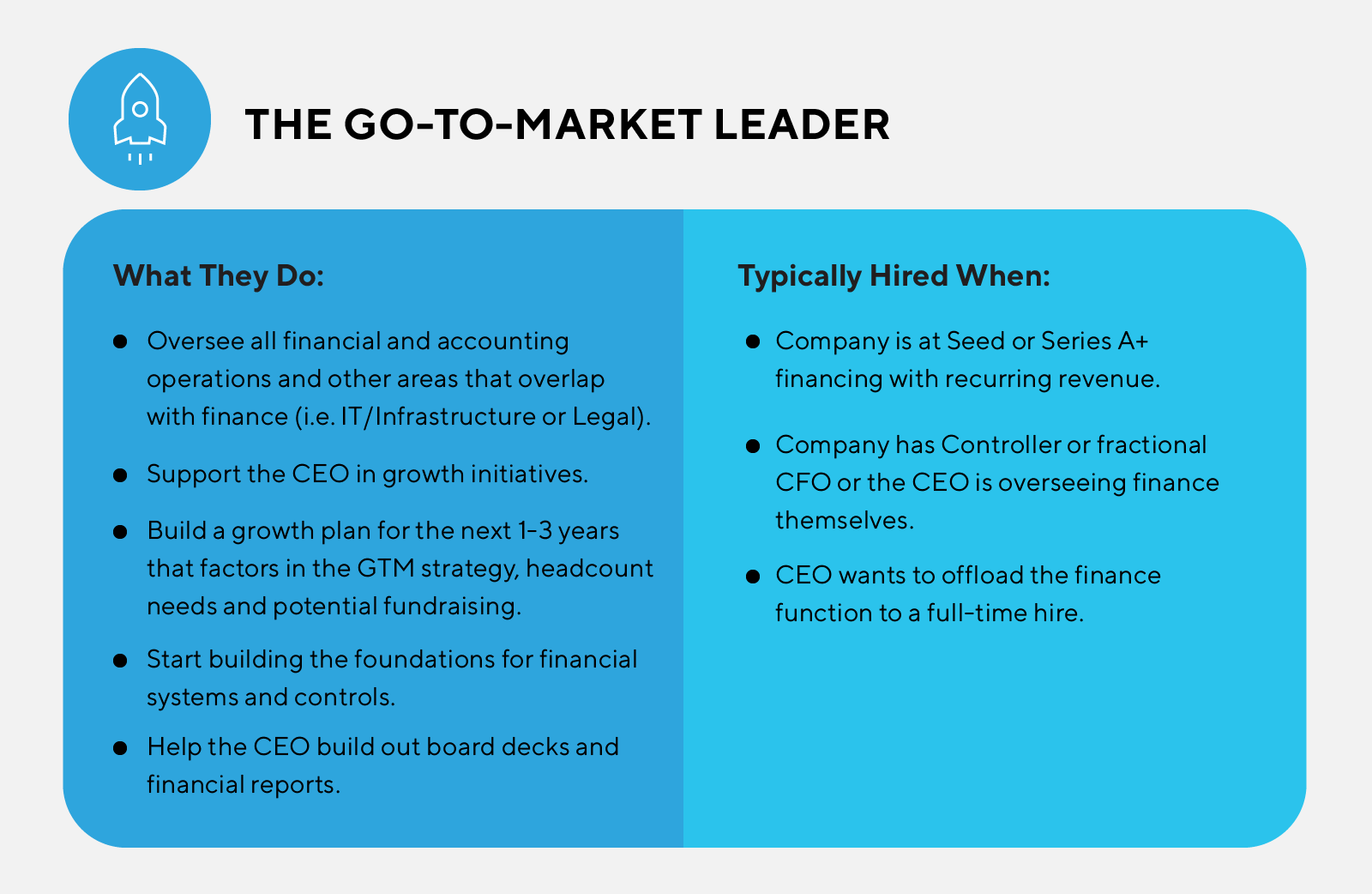

What They Do:

- Grow and scale the finance function, with an emphasis on FP&A, treasury, and risk management.

- Create a strategic planning process for the company with departmental OKS and financial targets.

- Lead or support capital-raising efforts.

- Monitor and adjust the equity compensation strategy based on short- and long-term growth projections.

- Build out the finance team and infrastructure.

- Build or refine the financial model to drive sustainable growth..

Typically Hired When:

- Company is at Series B+ or $100M+ in ARR.

- The function aspects of financial operations and controls are in place, but further refinement and scale are required.

- The company needs a 3-5 year financial growth plan.

Organizational scale is the sweet spot where a CFO is really going to lead transformational growth. At this level, the CFO is dialed into every aspect of the business and is partnering with the CEO to create a multi-year financial strategy that will be continuously monitored and scrutinized. They’re also the Chief Marketing Officer (“CMO”) of the finance organization, helping the rest of the organization and board understand the financial roadmap of the company and their role in it.

On the backend, the CFO is building the infrastructure, systems, and processes needed to support and accelerate the next level of business growth. They are also helping the CEO forecast the company’s cash flow and fundraising needs, identifying expansion opportunities, and helping each functional leader develop a growth strategy.

Who to Look for:

Someone with a finance or accounting background with several years of experience leading transformational growth at a scaling business.

Part strategic thinker, part operator. At this stage, a CFO needs to be willing to roll up their sleeves and own much of the finance function with a plan to quickly hire exceptional leaders who can take on many of those responsibilities.

Someone who can lead internal planning, interdepartmental budgeting, and forecasting and own IT infrastructure and technology.

The most important quality to look for in an operational scaling CFO is someone who can be a thought partner and confidante to the CEO, says Contentful CFO Carla Cooper:

Questions to Ask During the Interview:

- What controls or processes have you put in place in prior roles to ensure accurate financial reporting?

- Tell me about the structure and culture of your finance team at your last job. How did you support team members and enforce accountability, and keep the team aligned with the company’s evolving goals?

- How do you support yourself professionally? Are there any external networks or peer groups you belong to that help you solve challenges and help you grow as a CFO?

- Tell me about a contentious interaction with a board member. How did you resolve the conflict and mend the relationship?

- Tell me about a contentious interaction with your CEO. How did you resolve the conflict and either find common ground or get them to see your point of view?

- What are three essential truths about the company you’d want to know within your first 90 days of being hired?

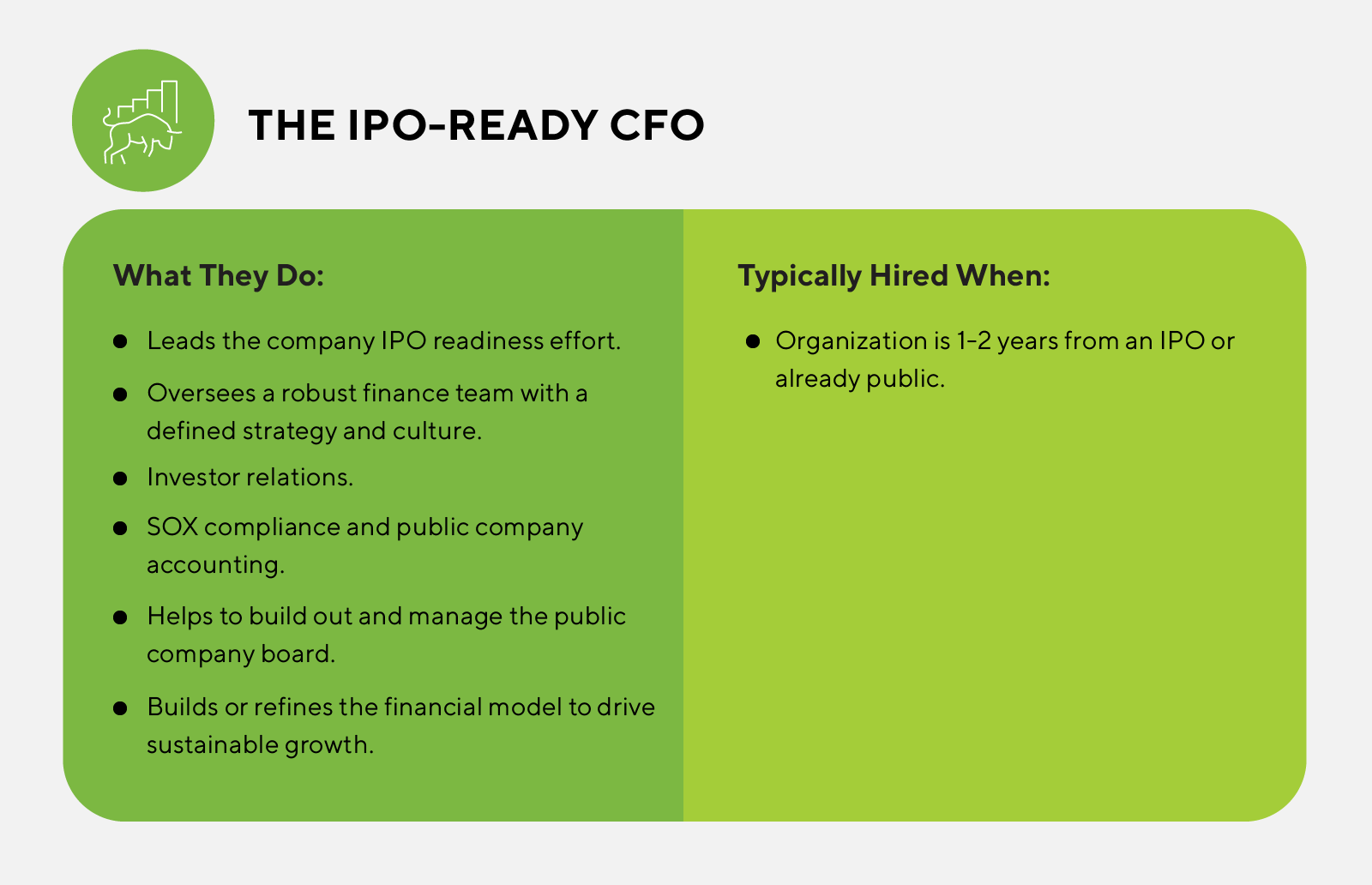

What They Do:

- Leads the company IPO readiness effort

- Oversees a robust finance team with a defined strategy and culture

- Investor relations

- SOX compliance and public company accounting

- Helps to build out and manage the public company board

Typically Hired When:

- Organization is 1-2 years from an IPO or already public

As the company moves closer to going public, the CFO will continue to operate in largely the same capacity but with two caveats. First, they’ll support the IPO readiness process, including building out the systems, processes, and people to support public company accounting and listing requirements. At this point, they’ll have a VP or Head of Finance who is leading most of the day-to-day financial operations, leaving them to focus on big-picture strategy and crafting the growth narrative of the business. Second, CFOs will spend significant time on investor relations and engaging with sell-side analysts. This process involves telling the story of the company and connecting the dots between the company’s historical financial performance, financials, KPIs, and long-term strategy.

At this stage, you need a CFO who’s a great data-driven storyteller, explained Tracy Knox (former CFO of Rover):

Who to Look for:

Someone with public company experience can be valuable, as they’ll be familiar with the IPO transition. It can help pressure test the company’s systems, people, and processes to identify gaps that must be filled before going public.

Someone with investment banking experience who feels comfortable leading IPO roadshows and conversations with investors or sell-side analysts.

Someone that is willing to take on the aspects of public company life that the CEO does not or cannot handle.

Most importantly, public or soon-to-be-public company CFOs need to prepare for the heightened scrutiny and publicity from being in the public markets. In many ways, the CFO is the face of the company and needs to be someone willing to talk investors through significant stock price changes or material company events.

Questions to Ask During the Interview:

- What do you see as your biggest priorities as CFO?

- What would your roadmap look like if we decide to go public in the next 12 months?

- How do you prefer to interact with other leaders and your CEO?

- What’s your oversight process for your heads of accounting and FP&A?

The CFO's First 90 Days

Once you’ve hired a finance leader, they will hit the ground running. The first 90 days are an opportunity for that individual to gather inputs, form their assessment of the business, and put in place the building blocks of their financial strategy.

We asked our experts to share how they tackled their first 90 days at a new company and what CEOs can do to support them during this crucial onboarding period:

Building Relationships with the Other Executives

Every leader highlighted the importance of meeting with the executive team to learn about their most significant priorities and challenges. While these conversations might seem like a formality, they’re valuable opportunities for the CFO to build trust and an open dialogue.

How CEOs can support them: Give your CFO some space during this time. Let them focus on building relationships with the other leaders and gathering information. It’s important for CFOs to be seen as valuable business partners rather than an extension (or spy) of the CEO. They will have plenty of time to start digging into the financial model and sharing their growth projections. However, in this initial period, allow your CFO the space to independently develop a hypothesis about what’s working and not working at the company.

Building Trust with the CEO

CFOs know they need time to earn the trust of their CEO. In the beginning, they’ll need to do a lot of active listening and joint working sessions to gain a shared understanding of what’s happening at the business.

How CEOs can support them: Give them as much time as you can afford to spare. Your CFO will have more questions than answers, but patience and giving them time to download your business knowledge is critical. Don’t be concerned if they’re bombarding you with information or questions. At the same time, take opportunities to get to know them more on a personal level, as this is a person you’re going to spend a lot of time with.

Strengthening Their Network

Your CFO might not have domain expertise in every area you need them to have, but they’ll know the value of outsourcing that knowledge. Your CFO will likely want to form connections with peers at companies of a similar growth stage or industry to build a private network they can turn to for support..

How CEOs can support them:Encourage your CFO to attend networking events and dinners, join a CFO community, or find a CFO mentor. If and when possible, leverage your network to connect them with CFOs who can help fill their knowledge gaps. It can also be mutually beneficial to start building connections between the CFO and the Board of Directors.

The CEO-CFO Relationship

Studies have shown that the CFO’s relationship with the CEO is the most important driver of CFO retention. Our experts agreed that building and refining this relationship over time is critical. “It’s a marriage of sorts,” said Greg Henry, pointing out that CFOs often spend more waking hours with their CEO than their spouses. Disagreements will happen, but CEOs and CFOs need to be closely aligned on a shared set of values and a basic financial philosophy; if that changes over time, it may become necessary to have some difficult conversations.

Carla Cooper added that it’s important for CEOs and CFOs to show a united front to the rest of the organization: “There can’t be any daylight between the CFO and CEO, particularly when introducing strategic decisions that will impact the executive team or broader organization.”

After the CFO’s first 90 days, you’ll want to set a recurring cadence of check-ins with them and decide together where those conversations will focus. In an earlier-stage company, CEOs might need to stay keyed in on the financial operations; however, at a certain level of growth, they’ll need to be ready to focus on more strategic conversations with their CFO. “As you get into the later stage of growth, the hope is that the CEO is not asking any questions on the finance/accounting side because they feel confident you have the right systems, people, and processes in place,” said Tracy Knox. “Conversations with the CEO should be about new strategic opportunities, capital allocation decisions, and cultural and organizational design decisions that need to be made.”

Of course, facilitating those strategic conversations requires CEOs to encourage their CFOs to speak openly and honestly. As Corley Hughes noted, “CFOs need to feel comfortable raising issues with their CEOs and occasionally pushing back on the CEO if the data doesn’t align with their perspective.” One way to encourage those types of conversations is to start with an open-ended question, said Michael Golub. “I’ll ask my CEO, ‘What’s keeping you up at night?’ or ‘If there’s one thing you would want to see us accomplish in the next X months, what would it be?’”

Caleb Hill advised CEOs to remember that a CFO’s true value isn’t validating or executing on the CEO’s perspective but rather helping to facilitate better decision-making: “Your CFO brings the data lens that should hopefully provide context around where the business needs to move forward. They’re not there to say no or be the gatekeeper of resources, but rather to provide an objective viewpoint based on inputs gathered across the organization.”

Final Thoughts

Bringing a CFO into your organization can unlock transformative growth and collaboration. Beyond their role as the head of finance, CFOs need to be comfortable building connections with every functional leader and helping them solve their challenges.

Great CFOs know how to balance financial integrity with a forward-thinking mentality and are not afraid to raise issues when the data highlights them. At the same time, they need trust and transparency with their CEO to do their job well. But, make no mistake, CFOs are incredible business partners - and we’re lucky to have met some incredible CFOs right here in The Circle.

Hiring Resources

from our friends at Hunt Club

A sample CFO job description template, including key responsibilities and requirements.

A set of recommended interview questions for vetting CFO candidates.