https://www.founderscircle.com/wp-content/uploads/2023/11/State-of-Venture-Debt-Blog-Banner-800x400-1.png

400

800

hannah@fcc.vc

https://www.founderscircle.com/wp-content/uploads/2022/02/fc-logo-updated-600x189.png

hannah@fcc.vc2023-11-17 17:37:552024-05-24 01:39:29The State of Venture Debt

https://www.founderscircle.com/wp-content/uploads/2023/11/State-of-Venture-Debt-Blog-Banner-800x400-1.png

400

800

hannah@fcc.vc

https://www.founderscircle.com/wp-content/uploads/2022/02/fc-logo-updated-600x189.png

hannah@fcc.vc2023-11-17 17:37:552024-05-24 01:39:29The State of Venture DebtAs we look forward to 2024, we remain focused on supporting current and future portfolio companies and continuing to build a leading community for growth stage executives and management teams.

With the closing of our fourth fund this past year, totaling nearly $1.3B under management, we reflect on how, over the past 11 years, we have been privileged to invest in 85 companies, 19 of which are now publicly listed. 24 more were acquired by strategics.

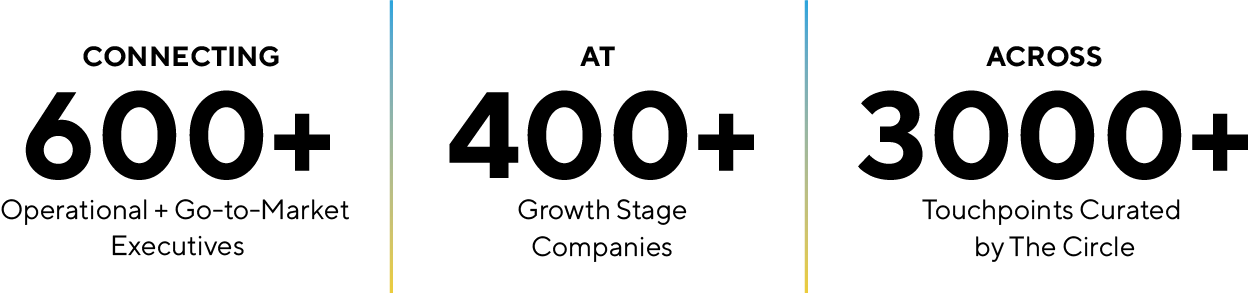

Core to our investment strategy are the investments we make in the professional and leadership development of the people who build companies—powered by a private community, The Circle—and in allowing those companies and their leaders to keep building.

In a tumultuous year for the venture and startup ecosystem, we have remained disciplined in our investment approach, focused on deploying capital to market-leading companies with exceptional management teams and demonstrable capital efficiency. We are proud to support these exceptional companies across these fast-growing sectors. 1

In another year of macroeconomic headwinds, community members of The Circle showed up for one another, offering peer support and actionable insights with every new challenge that came their way.

We’re deeply inspired by the “give to get” ethos, raw vulnerability, and commitment to excellence shared by all members of The Circle. This is precisely why we created The Circle – to give leaders a space to scale themselves while they scale their companies.

Connecting leaders within and outside of our investment portfolio, building an ecosystem of shared learning.

Best practices and scar tissue on operational and leadership challenges leaders face in their day-to-day.

Playbooks to help identify and onboard exceptional leaders across the C-suite that help drive the next phase of transformational growth because great people make great companies.

1) Total Invested by Investment Theme across all FCC Funds.