Table of Contents

Share this entry

The IPO Readiness Guide for CFOs (2021 Edition)

Sage advice on going public from battle-tested CFOs

Going public is a major company milestone and one that probably every late-stage private company CEO and CFO wishes they had a playbook for. Particularly for the CFO, there’s a lot to consider beyond the logistics like pricing, offering structure, listing and compliance requirements, and investor relations. Transitioning from private to public can dramatically alter the chemistry and operations of a company, which is why it’s so important to have the right people, processes, systems, and mindset in place. And then, of course, you have to plan for the unexpected.

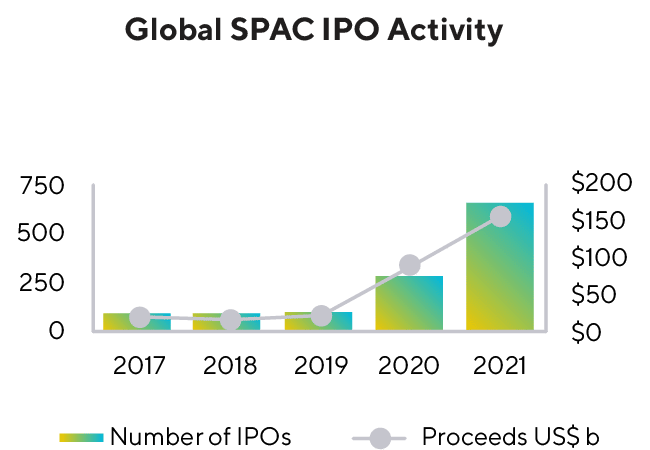

Just look at the variables that have shaped the IPO market over the last two years. From the meteoric rise of SPACs to a pandemic that caused major market volatility, CFOs have had a lot to consider before diving head-first into the public markets. For leaders that thrive on order and predictability, there certainly seems to be very little of that in today’s climate!

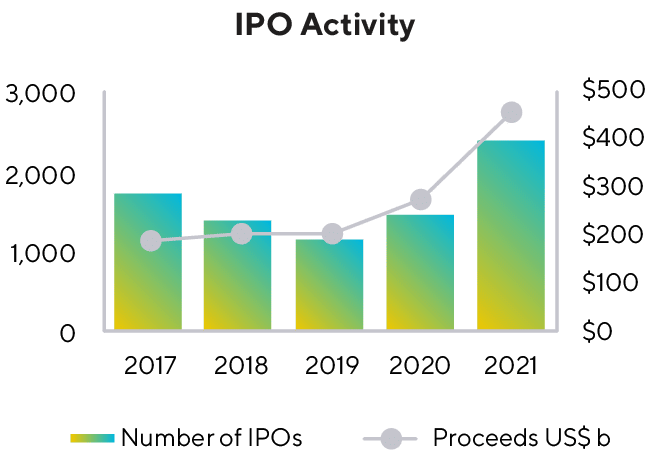

However, in 2021 many private companies are still going public (including 9 Founders Circle portfolio companies) and the global IPO market remains strong. In fact, 2021 was the most active year for IPOs in the past two decades.

Source: 2021 EY Global IPO Trends Report

Source: 2021 EY Global IPO Trends Report

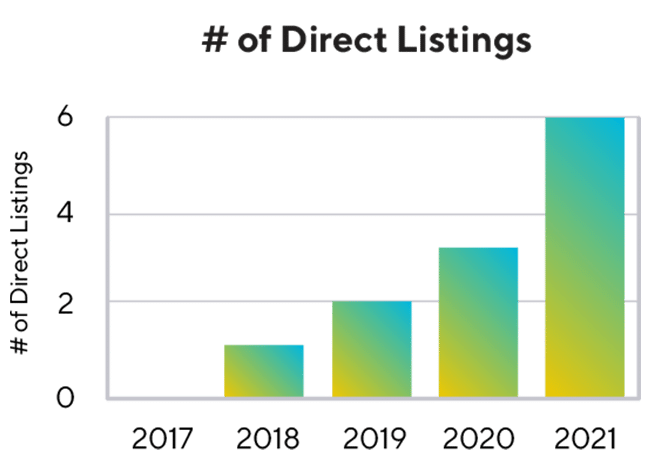

Source: 2021 EY Global IPO Trends Report; MKM Partners “2021 IPO Recap”

While a definitive playbook for determining when and how to go public simply doesn’t exist, what CFOs can look to – and what we try to supply in ample quantity here within The Circle – is the experience of battle-tested CFOs who once sat in their position. Looking back at the series of candid “Ask Me Anything” conversations we’ve had over the last few years, we found pearls of wisdom around what to prepare for when going public. This included everything from:

Below is our modest attempt to share some of the wisdom of our CFO guest speakers. Given how quickly the public markets change, we plan to update this guide on an annual basis – so be sure to bookmark this page (or just follow us on LinkedIn, and you won’t miss a thing). And, if you’re interested in gaining access to our private leadership community to exchange insights and gain support among a trusted set of peers, don’t hesitate to apply to join The Circle.

So, without further ado, here are some of our favorite insights on navigating The Road to IPO, extracted from live peer-to-peer conversations within The Circle:

Timing and Readiness

There’s no standardized timeline or formula for deciding the right time to go public. To paraphrase our CFO experts: when you know, you know. Rather than fixate solely on market demand or let fundraising needs or liquidity pressures tip your hand, CFOs should carefully review their internal metrics and test the internal readiness of their teams before embarking on the IPO journey.

CFO Tim Bixby helped steer Lemonade to one of the best IPO debuts of 2020. In his “Ask Me Anything” conversation, Tim described how there was no “inflection point” that guided the timing of Lemonade’s IPO. Instead, as the company began to develop a more predictive set of financial performance data, he focused on ensuring the company’s key growth metrics (tied to their industry sector and biggest market dependency) were “bullet-proof” before heading into IPO conversations.

CFO Tim Bixby helped steer Lemonade to one of the best IPO debuts of 2020. In his “Ask Me Anything” conversation, Tim described how there was no “inflection point” that guided the timing of Lemonade’s IPO. Instead, as the company began to develop a more predictive set of financial performance data, he focused on ensuring the company’s key growth metrics (tied to their industry sector and biggest market dependency) were “bullet-proof” before heading into IPO conversations.

If you’re not sure where to start, Tim recommended sitting down with the CEO and Board to analyze the last few quarters of company growth and objectively decide whether it would be beneficial to go public.

In her AMA, former Unity CFO Kim Jabal shared that while an IPO had been on the horizon for quite a while, Unity’s CEO and other key players at the company took their time rather than trying to time the market. Unity began “testing the waters” early, talking to investors and laying the groundwork for relationships with long-term, high-conviction firms that would pay off down the line during the pricing and allocation processes.

In her AMA, former Unity CFO Kim Jabal shared that while an IPO had been on the horizon for quite a while, Unity’s CEO and other key players at the company took their time rather than trying to time the market. Unity began “testing the waters” early, talking to investors and laying the groundwork for relationships with long-term, high-conviction firms that would pay off down the line during the pricing and allocation processes.

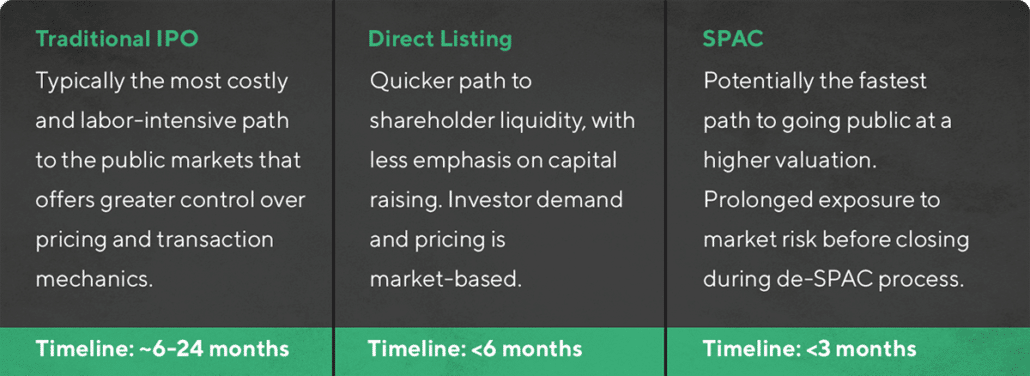

A big part of the timing conversation should also focus on optimal pricing and offer structure for the company’s public market debut. Companies might decide that a direct listing or SPAC are more advantageous routes to going public. Kim noted that Unity considered going public via a direct listing; however, she weighed how the rigor and breadth of the formal IPO process drives a greater level of demand and transparency versus a private raise followed by a direct listing. Unity ultimately designed its own unique IPO structure (what they refer to as a “UPO”) because it was best suited to Unity’s goals.

Source: Goldman Sachs, “Path to Public Life”

Chart Your Own Path to the Public Markets

Thinking beyond the logistics like pricing and structure, it’s important for CEOs and CFO to ultimately choose the path that best suits the company’s vision and long-term goals. That’s what Robinhood’s finance leaders CFO Jason Warnick and VP & Treasurer Shiv Verma learned during their two-year IPO journey. They began by establishing a guiding principle for their IPO, which was to provide customers with a more meaningful stake in the company’s growth. This led Jason and Shiv to pursue a more unorthodox share allocation approach of setting aside 35% of Robinhood’s IPO shares for retail investors. This decision set an important precedent, both internally at the company and with Robinhood’s existing and future shareholders.

Jason and Shiv strongly recommended every CEO and CFO begin the IPO process by writing a “first principles” document outlining the key objective of their IPO, whether it’s shareholder liquidity, capital raising, or share price growth. This is important groundwork that will ultimately guide future decisions and interactions with your shareholders, said Jason. Then, it’s up to you to really explore the possibilities of how to best achieve that objective with your underwriters. “You can take the best [parts] of direct listings and SPACs and bring them to [your] IPO,” said Shiv.

Crafting Your “Story”

Going public is very much a storytelling experience — that story being the vehicle for garnering interest and investment in your company’s growth. While that story is very much crafted by company leadership and the Board, the CFO plays a pivotal role in ensuring it matches the financial realities of the company. In other words, a CFO’s job is not just to tell a story that investors want to hear, but also one that shows the company’s strategy and can be used to justify major decisions in the context of business growth.

Criss Harms, former CFO of Forescout articulated the mission perfectly when he said that ultimately every investor, board member, and member of the management team views it as the CFO’s purpose to maximize their investment value. Especially in a post-IPO company, “your job, in their eyes, is to get the company liquid in a public company environment, and over the course of those next six months to a year, maximize the value of the company.” CFOs must therefore convey conviction and enthusiasm about their company’s future direction and demonstrate the measured temperament necessary for dealing with sell-side analysts and potential investors.

Avoiding Unhealthy Distractions

CFOs and CEOs often find that the IPO process can become an unintentional and unhealthy distraction for the company and its employees. Employees hear the word “IPO” and all of sudden feelings of excitement, confusion and maybe even a little bit of panic begin to settle in.

To keep your teams focused, shift the IPO narrative to one about public market readiness, said Couchbase CFO Greg Henry in his “AMA” conversation. That way, employees are not just preparing for the IPO but also what comes after it. “For two years, we were constantly challenging the business and different teams – from IT to product to marketing and even physical security – to think about what they were doing to get the company public-market ready. We made it a key theme for the business.”

Overcoming Greater Public Scrutiny

The flip side of the increased exposure an IPO brings is the scrutiny that often comes with it. And since they are so closely tied to a company’s financial performance, CFOs should be prepared to be in the hot seat more often after going public.

CFOs that have gone from private to public admitted that it is difficult to truly prepare for the increased public scrutiny when a negative story about the company arrives. CFOs also must be extra careful in their approach to sharing information, as mistakes or misinterpreted words often get amplified without context.

In his “AMA” conversation, 30+ year industry veteran and former CFO of Oracle Jeff Epstein described the ideal public company CFO as being objective, not over-hyping certain events in order to build credibility. By treating public shareholders as partners and giving them all the information they need to understand the company, a CFO builds trust that can help the company weather unexpected storms in the public market.

He described the role of public company CFO as being a “shock absorber” rather than a “shock transmitter.” Acting as a shock absorber requires leveling the emotional ups and downs that can befall a company. For example, when the company is doing well, the CFO must find ways to improve and not allow their team to get complacent, and when the company is not doing well, the CFO must remind his team of how good things have been in the past and how things will recover.

Having the Right Internal and External Partners in Place

Going public creates a whole new layer of financial requirements and complexities to navigate, and the CFOs that have gone through the experience were clear: the CFO can’t do everything alone. Transitioning to a public company CFO requires greater delegation to the right internal and external partners so that you focus more on the company’s overall financial health.

During former Forescout CFO Criss Harms’ AMA conversation, CFOs on the call agreed that a particular focus should be placed on hiring individuals to oversee controllership and financial planning and analysis (FP&A). These are the individuals that will be overseeing the day-to-day financial operations that the CFO simply won’t have time to monitor, which is why the CFO must establish an open and honest relationship with both roles. For the controller position, CFOs should look with someone that is laser-focused on the numbers (“there should be no ‘gray area’ in the metrics”). For the head of FP&A, a CFO needs someone that is incredibly detail-oriented and adept at operating financial spreadsheets and systems.

Kim Jabal (former CFO of Unity) also pointed out that hiring a head of Investor Relations (IR) with experience dealing with the ins and outs of Wall Street (preferably the sell side) will be vital during conversations about pricing and allocations. Beyond the functional roles, Kim also emphasized the value of having a mentor – one with IPO experience – to rely on for support and guidance during those unforeseen or complex developments. Having a strong team surrounding you is really important, as is choosing investment banking partners you can trust with confidential financial information.

Taking on a Bigger Role With the Board of Directors

When transitioning to public company life, CFOs will naturally assume a more central role in the company’s relationship with its board of directors. Financial performance will be top of mind for the board and it’s important for the CFO to project confidence and decisiveness when having those conversations with board members.

Criss Harms recalled how early board conversations leading up to Forescout’s IPO were largely disastrous, as he made the mistake of treating the board meeting “as a working session.” He later realized that the board was looking for him to really lead those strategic conversations, and to work out any operational issues separately with individual board members as needed.

CFOs can also sometimes underestimate how long it can take to develop a public market-ready board. Not only will you need to build out your three core committees – Audit, Compensation, and Corporate Governance – but you’ll also want to bring on experienced advisors that can help your company manage the IPO transition. That whole process can easily take a year and there are several things to consider when replacing or filling board seats.

You can read more about that whole process in this recap of a recent CFO|Circle Community discussion dedicated to transitioning your board from private to public life.

Becoming a Better CFO

Despite the scar tissue, the CFOs we spoke to ultimately grew from the experience of leading their company into the public markets. Some developed greater empathy for and relationships with their colleagues and external partners; others learned to find their voices as the measured pragmatists grounded by data-driven decisions.

Veteran CFO of multiple companies (including Twilio) Lee Kirkpatrick shared his thoughts on CFO leadership during his “Ask Me Anything.” At Twilio, one of the leadership principles that guided Lee’s conduct was the question, “Are you waking up every day and making your colleagues better?” While sometimes leaders will focus on making their specific team or their boss better, Lee stressed the importance of leveraging a CFO’s particular insight on the company’s operations to make each and every one of his colleagues better rather than tear them down.

Veteran CFO of multiple companies (including Twilio) Lee Kirkpatrick shared his thoughts on CFO leadership during his “Ask Me Anything.” At Twilio, one of the leadership principles that guided Lee’s conduct was the question, “Are you waking up every day and making your colleagues better?” While sometimes leaders will focus on making their specific team or their boss better, Lee stressed the importance of leveraging a CFO’s particular insight on the company’s operations to make each and every one of his colleagues better rather than tear them down.

Similarly, Jeff Epstein added that CFOs should learn to spend more time “editing their ideas” before sharing them with peers. Always assume that your employees are focusing on every idea you share, and to ensure those ideas are in service to the company’s broader vision, Jeff recommended CFOs think of their ideas as “a piece of a mosaic that might lead to a large solution.”

When In Doubt, Look to Your Peers for Advice and Support

This last bit of advice comes not just from our guest experts, but from all of us in The Circle.

When it comes to preparing for an IPO, don’t be shy about asking questions and leaning on the experience and advice of CFOs who have once sat where you sit now. We’ll continue to keep facilitating those conversations — and if you’d like to be part of them in the future, we encourage you to apply.

Related Blog Posts

The 2022 IPO Readiness Guide for CFOs

The Road to IPO: HashiCorp CFO Navam Welihinda on Going Public During Uncertainty