Trending

4 Considerations To Craft Your Company’s Equity Strategy

/in Talent, Featured on Home, Equity & Compensation, Trending, I Need to Retain my Top Performers, Developing Your Team, Secondary Liquidity/by Matt McCueAdvancing Your Influence: Strategies for CFOs

/in Leadership & Vision, CFO Leadership, Developing Your Team, Featured on Home, Trending, Talent/by Matt McCueHow People Leaders Can Invest In Their Own Growth

/in Featured on Home, Trending, Talent, I Need to Retain my Top Performers, Developing Your Team, Leadership & Vision/by Matt McCueShare this entry

409A Valuations in Turbulent Market Conditions

Navigating a Lower Valuation and Potential Option Repricing

With recent volatility in the public markets and the looming threat of a recession in 2022, private company CFOs are keeping a close eye on the impacts to their 409A valuation. Public comparables and financing activity are often key parts of the 409a valuation process (though the weighting depends on the valuation method you use); therefore, a prolonged market downturn can potentially lower the 409A valuation of a private company.

While a lower 409A may not necessarily be harmful in the long-term, it can create some considerations around how and when to issue or reissue private company stock at a lower strike price and implications for the overall equity plan and its participants.

To get answers to common questions and a pulse on the overall valuation market in 2022, we invited Steve Liu (Head of Valuation Services for Morgan Stanley at Work), David Oppenheimer (former CFO of Udemy turned board member and advisor) and Rocky Pimentel (Executive Chairperson for Afero) to chat with our CFO|Circle. Steve has personally overseen over 10,000 valuation opinions throughout his career at Morgan Stanley, Silicon Valley Bank, and KPMG, and is also the subject-matter expert for our 409A Valuation Guide for Private Companies. (If you’re new to 409A valuations or want to brush up on the fundamentals, we highly recommend reading through the guide.)

Here are some of the key takeaways from the conversation:

Fundraising and Secondary Activity May Predict Lower Valuations

Looking across the private markets, Steve and his team aren’t seeing an across-the-board decline in 409A valuations yet; however, he believes there could be a delayed impact in the latter half of 2022 as fundraising begins to slow down.

VCs raised $230 billion by the end of 2021, followed by another $70 billion in Q1 2022, said Steve. That funding may have provided a fair amount of insulation from the public sector so far. In general, pre-money valuations are still trending up, although later-stage investments are flattening. And we’re starting to see other warning signs—corporate VC activity is down, and there was a noticeable Q1 drop in mega-rounds ($100M+). “Even though early-stage startups had a record number of transactions in Q1, founders are being told to extend their cash runway for longer periods, with the understanding that the market could be at the peak of its downturn in the next 6 to 12 months,” he said.

For companies using the “backsolve” method of calculating their fair market value based on the last preferred round, a decline in fundraising activity or lower pre-money valuations may trigger a decline in their next 409A valuation price.

“For later-stage companies, as deal sizes and valuations begin to drop, coupled with significant market volatility in the public comparables, it frankly becomes increasingly difficult to justify or support values established from the prior 409A.” – Steve Liu, Head of Valuation Services for Morgan Stanley at Work

Similarly, decreased secondary activity may indicate less appetite among investors that parallels current funding trends. With fewer secondary transactions to benchmark against, it also removes some of the upward pressure on 409A valuations.

Public Sector Impacts to 409A Valuations

“The private markets are not immune to what’s happening in the public sector,” said Steve and he pointed to a few ways that prolonged market turmoil could impact the 409A valuation:

- Companies that use public comparables (e.g., market approach) in their 409A valuation may experience a significant valuation decline, as reflected in the performance of those peer companies if the public sector continues to exhibit an extended downturn.

- Any delays with IPO timing, even when exit values are unchanged from initial management/banker expectations, trigger a decrease in value as market volatility (see comment above), discounting of exit values (increasing over time) and potentially the discount for lack of marketability (increasing DLOM) all work in tandem to drive a decline in the company’s valuation.

- Over time, market downturns impact a company’s key performance indicators (long-term revenue growth, customer acquisition/churn, profit margin, etc.) which can impact companies who are relying upon a discounted cash flow methodology in their 409A valuation.

While all these public market factors can impact the 409A valuation, it’s important to provide context to your valuation provider and work with them to define the long-term implications. “There’s a justifiable hesitancy with 409A valuations to directly tie the company value to what’s happening in the public sector,” said Steve. “That’s especially true if your company has successfully completed a recent financing or is continuing to meet milestones during the market turbulence. It’s not a one size fits all.”

Conversations About Option Repricing are Starting to Happen

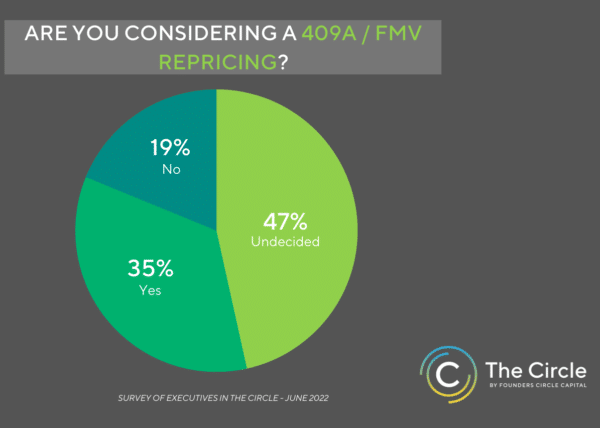

While the impact of the current market volatility remains uncertain, the majority of CFOs in The Circle are considering or undecided on whether or not to reprice their 409A:

Naturally, as Steve saw during the early months of the COVID-19 pandemic, questions are coming in from CFOs on how and whether to reprice new or existing options based on a new 409A valuation.

While option repricing is not a common practice, it can become a consideration if a company’s 409A valuation drops between 20-30% or during a market downturn. At that point, a company might choose to lower the strike price of existing or newly-granted options at or above the 409A price to generate potentially greater upside for new hires and existing shareholders, and make it cheaper for shareholders to exercise options or prevent existing options from becoming “underwater.”

Lowering your 409A valuation doesn’t mean you have to reprice options; however if you are planning to reprice, here there are a few things to consider:

- Do you expect the 409A valuation to fall further? You only get one shot at repricing options and, as David pointed out, “you’re essentially trying to guess the bottom of the market. If you try to reprice today and the markets continue to drop six months from now, you don’t get to push that button again, and your accountants will really change how they’re accounting for equity.”

- Will your board approve the new option price? Repricing is a complicated process that requires board approval. Investors on your board may or may not agree with the new valuation calculation or be supportive of granting options at a lower strike price while their preferred shares remain at the same price. Furthermore, if you’re issuing more shares at a lower price, they may be worried about the dilutive effect on the total option pool.

- How will employees react to the repricing? While private companies are not required to disclose their 409A valuation to employees, they must to inform shareholders whose options get repriced. Again, repricing is not necessarily a bad health signal for the company, but it can be perceived that way by employees that don’t understand the mechanics of 409A valuations. Furthermore, if you’re only planning to change the strike price of newly granted options, existing option holders may not like that they’re holding shares at a higher strike price than those issued to new holders.

Having gone through the process of repricing options, Rocky recommends spending a lot of time with your valuation provider to ensure their calculation has the appropriate weighting on market conditions. That weighting will depend on the companies in your public comp set and also the size of the option pool you’re planning to grant during a period of market volatility.

An alternative to repricing options CFOs of later-stage private companies might also consider is to switch from issuing options to issuing RSUs. RSUs are considered “lower risk” during significant 409A valuation declines because they do not need to be exercised (therefore cannot become underwater) and are taxed at the time of vesting. Companies can also cancel and replace existing options with RSUs; however, as Steve has pointed out in a prior discussion on 409A valuations: “Swapping for RSUs creates the challenge of determining what the equivalent amount of RSUs would be. The swap requires a full tender offer; it comes with many disclosure requirements (including a disclosure of projections to employees) and, of course, lots of lawyer work.”

The Takeaway:

Private companies may not be feeling the market impact on their 409A valuations yet, but that could change in the second half of 2022. It’s important to recognize that 409A valuations are an independent measure of common stock value; lower 409A valuations may not necessarily be a bad omen for the company and they may even generate more equity upside to help support employee recruitment or retention.

Always navigate changes to 409A valuations with the support of your inside and outside counsel, board of directors, and advice from your valuation service provider.

Read the Founders Circle Capital 409A Valuation Guide created in collaboration with Morgan Stanley at Work to learn more about the valuation process. If you’d like to join conversations like this one with other growth-stage leaders, apply to join The Circle.

Related Blog Posts

4 Considerations To Craft Your Company’s Equity Strategy

Advancing Your Influence: Strategies for CFOs