Trending

4 Considerations To Craft Your Company’s Equity Strategy

/in Talent, Featured on Home, Equity & Compensation, Trending, I Need to Retain my Top Performers, Developing Your Team, Secondary Liquidity/by Matt McCueAdvancing Your Influence: Strategies for CFOs

/in Leadership & Vision, CFO Leadership, Developing Your Team, Featured on Home, Trending, Talent/by Matt McCueHow People Leaders Can Invest In Their Own Growth

/in Featured on Home, Trending, Talent, I Need to Retain my Top Performers, Developing Your Team, Leadership & Vision/by Matt McCueShare this entry

Handling 409A Valuations In the Era of COVID-19

The CFO|Circle came together with Steve Liu (Shareworks, SVB, KPMG) to share insights on whether the current volatile market might impact valuations of private companies and, if so, steps CFOs might take to position their companies for this reassessment. Of course, the 409A has many interdependencies which doesn’t allow for one best go-forward plan applicable for all growth-stage companies. But, observations gleaned by scores of conversations and valuations over the past several weeks might shed light on a path forward.

Before examining how COVID-19 and the economic fallout has affected 409a valuations, it’s worth reminding our readers about the purpose of such valuations. It is simply a conservative estimate of the Fair Market Value (FMV) of a company’s common stock, used primarily to set an exercise price for subsequent option grants.

A decline in your 409A valuation does not indicate that the business is failing, nor does it mean that your next fundraise is doomed, but it does have a profound impact on employee compensation.

In the latest “CFO Circle Call”, we had Steve Liu on to help our community get us up to speed on the situation. Steve is a long-time friend of Founders Circle and currently runs the valuation practice at Shareworks by Morgan Stanley.

What’s Happening to 409A Valuations

As you surely know, public comparables analysis is one of the key determinants of 409A valuations. With the S&P 500 down 14% from the beginning of 2020 it should come as no surprise that private company valuations are beginning to decline as well. Below are a few broader trends Steve is seeing:

Tender Offers on Pause

- Secondary activity has fallen off dramatically. Quarter over quarter, somewhere between 40 to 60%. For the few with steady Q1’s, still, the vast majority of volume took place in January and February, before the pandemic really took hold here in the States

- For those who have pushed forward, it’s primarily out of prior obligations

Equity Compensation

- For early-stage startups, we are seeing a swap that employees have from a compensation perspective, in terms of getting more equity and perhaps getting discounted compensation or salary with the expectation of a longer-term payoff

- For late-stage companies, layoffs are not uncommon. The focus for these companies has been on retaining top talent, meaning most engineering and product roles are safe

409A Valuations Press On

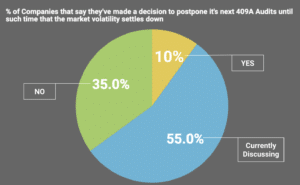

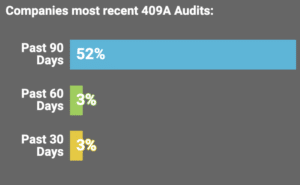

- While there are a few rumors around delayed or canceled 409A valuations, this is exactly that, just a rumor

- Steve has not seen a let-up in the number of 409A valuations being completed, which is supported by our survey of CFO participants

Getting Your 409A Valuation Right

Institutions like the International Valuation Standards Council, IBSC, and International Private Equity and VC Calculation Board are releasing guidance on 409A valuations, which is slated toward the investing house but still broadly applicable. We summarize this for you below:

Prior Valuations are Stale, But Not Irrelevant

For prior capital rounds, although the pricing may have been a good indicator of price, these valuations are now outdated given the current situation. However, that does not mean they should be ignored. In fact, at Shareworks, Steve continues to start with those valuations as a benchmark.

“Don’t Over Engineer Maintainable Earnings”

In plain English, this means you should not overly emphasize short-term market risk. There is a difference between uncertainty and risk and they should not be conflated.

For this reason, companies should provide an honest estimation in their forecasting and avoid minimizing the pandemic or get too philosophical. IBSC’s quote sums this idea up nicely:

“The objective of the valuation is not to stress test the valuation to an extreme case.”

Be Intellectually Honest

This is a foundation of our culture here at Founders Circle Capital and has never been more imperative than now. An honest and straightforward estimation of the recession’s impact on your business, based on available information, will be paramount. Questions Steve recommends companies ask themselves:

- How much really does the market volatility in the short term impact your startup’s long term forecast and prospects?

- If your time horizon is several years or longer, is it reasonable to expect the current market to drastically alter the growth trajectory of your business model?

The key question to be answering is about how correlated your business is with the markets.

Extend Your Forecasts

There has been a push by the audit community to have forecasts extended out 3-5 years. This is essential, not simply because of the use of DCF analyses during valuation but because it prevents an over-emphasis on short-term performance.

Stage-Specific Impacts on 409A Valuations

If you’re an early-stage startup, you more likely than not to have a far shorter cash burn runway. Coupled with financing and business risks, this creates a potentially imminent risk that will be factored into 409A valuations via liquidity discounts. This furthers our point from last week’s takeaway, where we suggest preserving at least 18 months of cash runway

For later-stage startups, the risk is less immediate. Typically COVID means delayed exit timelines and growth challenges, which will be factored into the valuation.

Who is Impacted? Stakeholder Analysis

Let’s start by analyzing the impacts of a lower 409A valuation on the various stakeholders.

New Employees

A lower 409A valuation provides a great opportunity for new employees. This will allow for significant value appreciation on employee options and can be a powerful tool for recruiting top talent

Investors

Traditionally, investors like us care a lot more about option dilution than we do the strike price on those options. That remains true. As alluded to at the beginning of this post, it’s unlikely to scare off new investors as well, as they understand 409A valuations are separate analyses.

Note: At the end of the day, a decreased 409A may cause a decrease in term sheet valuation, though so long as that value isn’t based on the 409A then it should be considered a normal market correction

Existing Option Holders (Your Staff)

This group is the most affected. In many cases, existing option holders will find themselves stuck with options that have a higher strike price than those issued to new holders.

Now What? Tactics on Option Pricing Adjustments

Finally, let’s move onto what companies can do about their new 409A valuation. As cases arise where there’s a 20-30% decrease in the value of common stock, decisions about equity compensation are becoming necessary, and usually take place at the board level. Here are the options these boards are mulling over:

Option Repricing

The most common solution is to reprice options at the new 409A valuation, or cancel existing options and re-issue them at the new exercise price.

In general, repricing is not a common practice, so the drop in share price should be material. That threshold will differ for each company, but anything beyond a 25% drop in price could merit consideration. Also, you should consider whether the value recalibrates in another 6-12 months. In discussions with our Compensation practice, the historical precedent has been that earlier-stage startups typically rebalance employee equity/comp allocation (base versus equity comp), so lower-priced equity represents future upside. Later-stage or public companies tend to layoff employees and concentrate resources on essential talent (keeping their comp packages whole). There are a few Shareworks valuation clients discussing repricing at the Board level, so this continues to be an evolving topic of conversation.

In the former case, it’s worth noting that once you reprice an option tranche you cannot do it again. You only have one shot at re-valuing the company.

Swapping Options for RSUs

Swapping options for RSUs is an interesting strategy worth considering, though few companies have gone through with this yet.

The reason being is that it comes with some added baggage. First and foremost, swapping for RSUs creates the challenge of determining what the equivalent amount of RSUs would be. The swap requires a full tender offer, it comes with many disclosure requirements (including a disclosure of projections to employees) and, of course, lots of lawyer work.

Business As Usual

Remember, not all 409A valuations will require these drastic actions. For the lucky few they may even increase. In light of this, it’s important to understand the gravity of these decisions.

Repricing options is a complicated process that will require board approval, re-valuation for investors, and a slew of other complications. It should come as no surprise then that many boards are on the fence about what to do here.

Though only one of a million items to be impacted by this crisis, 409A valuations and the subsequent decisions will have long-term impacts on equity compensation.

Related Blog Posts

4 Considerations To Craft Your Company’s Equity Strategy

Evolving Your Compensation Plan on the Road to IPO