Trending

4 Considerations To Craft Your Company’s Equity Strategy

/in Talent, Featured on Home, Equity & Compensation, Trending, I Need to Retain my Top Performers, Developing Your Team, Secondary Liquidity/by Matt McCueAdvancing Your Influence: Strategies for CFOs

/in Leadership & Vision, CFO Leadership, Developing Your Team, Featured on Home, Trending, Talent/by Matt McCueHow People Leaders Can Invest In Their Own Growth

/in Featured on Home, Trending, Talent, I Need to Retain my Top Performers, Developing Your Team, Leadership & Vision/by Matt McCueShare this entry

Should You Offer an Employee Bonus Program?

CFOs and CHROs Discuss the Impact and Mechanics of Bonuses

There’s been a healthy debate around bonus programs brewing in our CFO and CHRO communities. While bonuses have long been a tool for companies to help attract and reward, in today’s hyper-competitive talent market finance and people leaders are questioning their impact on productivity and retention. Furthermore, the increased complexity of bonus program structures has many leaders wondering whether they should still be a key component of the total compensation strategy.

To hear both sides of the bonus debate, we invited CFOs and CHROs to participate in a conversation about the merits and considerations of having a bonus program (the discussion focused solely on compensation not including sales and commission roles). Leading the discussion were five experienced finance and people leaders with plenty of scar tissue and opinions on bonus programs: Brian Robins (CFO) from GitLab; Greg Henry (CFO) and Chris Galy (CPO) from Couchbase; Sandy Smith (independent board member and former CFO of Segment); David Oppenheimer (Audit Committee Chair at Quotient and former CFO of Udemy).

Where Companies Sit on the Bonus Spectrum

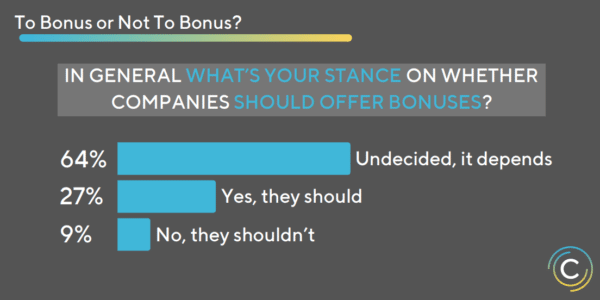

To begin the discussion, we asked CFOs and CHROs to share their opinions on whether companies should still offer bonuses to employees. Only a small contingent voted in favor of eliminating bonuses, and the majority fell in the “undecided” category – perhaps indicating that there is quite a bit of nuance to the debate.

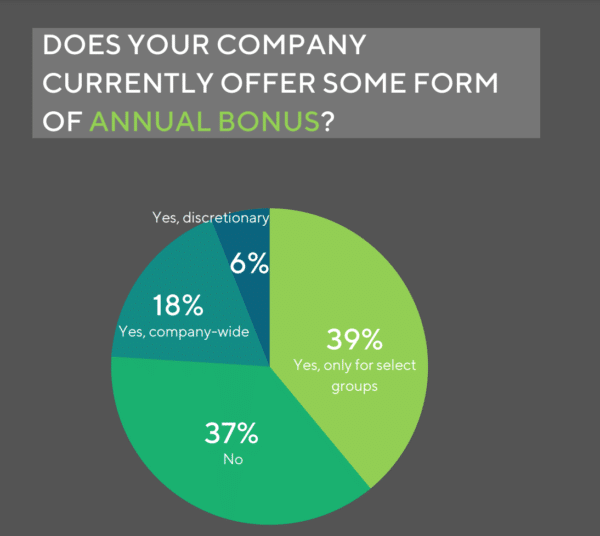

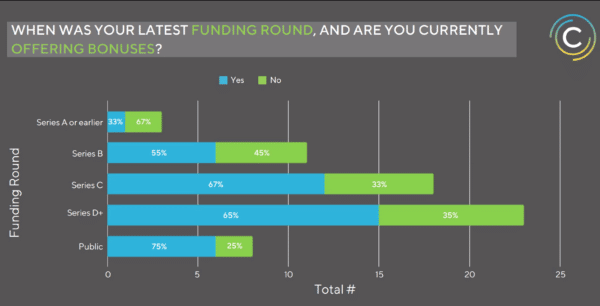

Most companies represented in the discussion offered some sort of bonus program. When broken out by company stage, participation tended to increase alongside company maturity.

The Role of Bonuses in Overall Compensation

To help frame the conversation, we asked our panel to define the role of bonuses in overall compensation. David Oppenheimer framed the role of bonuses as such:

“Bonuses help bridge the gap between base pay, which is determined by the market, and equity, which drives long-term incentives. They represent short-term incentive compensation based on individual and company performance within a given year. The right bonus program with the right incentives to the right people can drive performance.” – David Oppenheimer, independent board member and former CFO of Udemy

David added that, during market downturns or when equity value is diluted, bonus programs become one of the key levers for maintaining employee satisfaction and retention. To companies not offering bonus programs, he posed the question, “In today’s market, where we’re all measured on employee retention, how will you bridge that gap if equity comp (based on stock price performance) is not aligned with the company’s success?”

GitLab offers a number of discretionary bonuses to employees, and CFO Brian Robins believes that they are an important part of the company’s compensation philosophy:

“Bonuses aren’t just about talent recruitment and retention, but also aligning employees and shareholders so that everyone is sharing in the company’s success. We’re extremely transparent – all the quarterly business KPIs set by the CEO are publicly available on our website, so that employees and teams know how their variable compensation is calculated.” – Brian Robins, CFO of GitLab

One of the fundamental reasons why companies offer bonuses is to incentivize better employee performance, something that Chris Galy of Couchbase finds is happening less and less: “We’re seeing research where employees are saying bonuses are not the primary driver of performance. Furthermore, 98% would prefer the predictability and financial stability of knowing their total compensation.”

Greg Henry of Couchbase added that the performance lift coming from bonuses isn’t always large enough to justify the programs. Instead, companies can put that money back into on-target earnings (OTE) and restructure bonuses into merit or equity grants to reward performance. “That way, employees get rewarded for what they’re doing every day and don’t have to wait a year or parts of the year for a bonus.”

Misalignment between the intention of a bonus program and the actual results that it drives is an important consideration, and it led to the big next question on the minds of our CFO and CHRO audiences:

Will Not Offering a Bonus Hurt Talent Acquisition and Retention?

If candidates and employees expect a bonus as part of their overall compensation, can companies afford not to offer them? While earlier-stage companies may be able to lean heavier on equity compensation for employee recruitment and retention, later-stage companies tend to encounter more frequent bonus conversations, said Sandy.

“Particularly when you’re recruiting more tenured leaders from larger organizations, they’re used to a more cash-heavy compensation package. If you’re competing on base pay or equity alone, you can sometimes be at a disadvantage and have to offer a higher bonus package.” – Sandy Smith, former CFO of Segment

David added that bonuses, when used effectively, can be a strategic lever for attracting upper-level talent without breaking your compensation bands. “It preserves the leveling of your salary structure without forcing you to walk away from a key candidate necessarily. However, one CHRO pointed out, “it can be a slippery slope.” If you start accommodating multiple bonus requests or wading into the territory of executive-only bonuses, at some point, you’ll have to figure out how to scale across the organization.

Chris noted that the tangible benefit of a bonus program doesn’t always resonate with employees and candidates.

“At the end of the day, most people will compare W-2 to W-2. Therefore, bonuses can work for or against you depending on how they’re communicated.” – Chris Galy, CPO of Couchbase

If you’re going to allocate more variable compensation, new hires need to understand the upside opportunity of the bonus and expected total payout; and for employees, if you’re moving a portion of existing cash compensation to bonuses, you may have higher attrition from those who prefer more financial certainty.

Who Gets Bonuses and How Much?

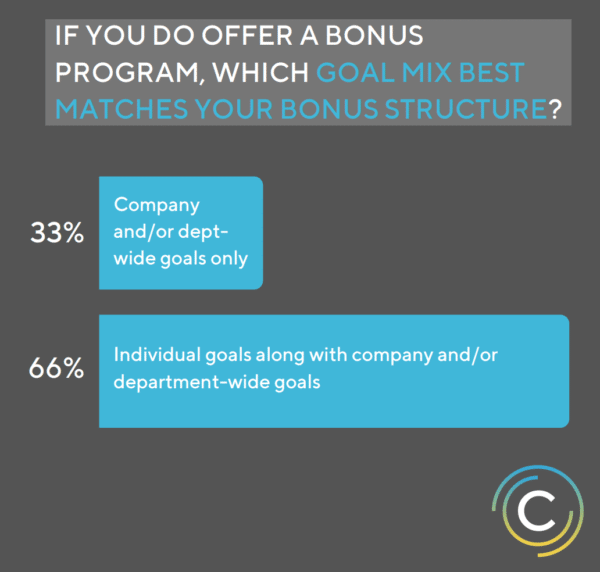

We heard a mix of approaches to bonus program structure; some offered bonuses to director-level and above while others offered them company-wide. Most companies appeared to be taking a phased approach, focusing first on executive-level hires. As bonuses start rolling out more broadly, careful attention should be paid to the variable of company performance versus individual performance driving total payout.

One CHRO shared that their company has a sliding scale that increases the weighting of company performance-driven payout for more senior-level executives. Individual performance factors tended to be weighted higher for less experienced employees, with input from their managers.

It’s essential to have the right ratio of individual and company-driven bonus factors, but you also want to avoid over-engineering the strategy, said Greg.

“If you’re doing a bonus program, try to keep it as simple as possible. Really focus on rewarding the people and contributions that are going to drive market and enterprise value over the next several years.” – Greg Henry, CFO of Couchbase

Aligning Bonuses With OKRs & Business Goals

Tying bonus programs to broader OKRs and team goals is one way to help simplify the approach. Goals can be at the individual- and company-level, with the vast majority of companies represented in the discussion using a mix of both:

For the company goals, some of the popular top-line metrics used to fund bonus pools were:

- Annual recurring revenue (ARR)

- Net recurring revenue (NRR)

- EBITA

- Gross margins.

It’s important to pick the right metrics and recognize each team’s individual contributions, said Sandy. “Those contributions don’t always show up on a generic P&L statement. With marketing, for example, you might allocate a certain portion of the bonus to top-level demand gen metrics.” Team goal establishment is a collaborative exercise, she added, and often takes multiple cycles to do it correctly.

There are times when you’ll also need to look at total payouts with sensitivity to market conditions, one CHRO noted. For instance, if your company misses the revenue target due to an unforeseen business headwind (like the COVID-19 pandemic), you might consider a separate discretionary bonus plan to ensure employees don’t suffer.

Bonus Program Administration

A key theme from the discussion was that structuring and implementing an effective bonus program isn’t easy. It takes cycles of recalibration to get it right, and if you’re rolling one out for the first time, consider phasing it over multiple years, one CFO recommended.

Once you have the right foundation in place, budget anywhere from 3-6 months annually for the end-to-end process: bonus calculation, calibration, review, payout, and communication. Chris noted that the payout period alone typically takes over a month and a half and becomes incrementally more complex as your business grows.

There are systems and tools CFOs and CHROs recommend to help simplify the process. The most popular solutions highlighted in our propriety CFO software stack (made available only to The Circle Community) were:

- Google Sheets

- Tableau

- Looker

- Domo

- Mode

“The more work you do upfront to structure the program, the less time needed at the backend to fulfill against it,” David concluded.

Want to join conversations with other CFOs and CHROs at fast-growing companies? Apply to join The Circle and gain access to a private leadership community for sharing and receiving advice and support.

Related Blog Posts

Advancing Your Influence: Strategies for CFOs

How People Leaders Can Invest In Their Own Growth