Trending

4 Considerations To Craft Your Company’s Equity Strategy

/in Talent, Featured on Home, Equity & Compensation, Trending, I Need to Retain my Top Performers, Developing Your Team, Secondary Liquidity/by Matt McCueAdvancing Your Influence: Strategies for CFOs

/in Leadership & Vision, CFO Leadership, Developing Your Team, Featured on Home, Trending, Talent/by Matt McCueHow People Leaders Can Invest In Their Own Growth

/in Featured on Home, Trending, Talent, I Need to Retain my Top Performers, Developing Your Team, Leadership & Vision/by Matt McCueShare this entry

A Look at the Consumer Public Company Playbook

The Circle gathered this week with our consumer-focused CEOs and CFOs to discuss the consumer tech market playbook, from the perspectives of public company CEOs, CFOs, and Boards. Umi Mehta & Shaan Tehal of Morgan Stanley joined the group to synthesize for them what they’ve learned from scores of public company leadership conversations.

Here were the key takeaways from the Circle|Call:

Consumer Internet Market Update

Internet is an extremely broad category that spans everything from e-commerce to gaming to marketplaces, so when referring to ‘internet’ be aware that there’s a lot of different caveats within that. But the one thing that’s certain is that it’s impacted, and for the most part, it’s right down the middle in terms of the level of disruption.

Drawing Conclusions from Public Company Guidance

- Of the ~60 internet companies, they’re tracking, 73% have taken away full-year guidance, which reflects the broad impact on the sector

- Companies with subscription-based revenue models, compared to transactional-based revenue models, for example, have far more visibility into future performance

- This explains not only why they’re more likely to provide guidance but also why public investors are investing heavily in the software space, which Alex Clayton @ Meritech does a great job of explaining in his most recent article

- There are some clear beneficiaries. Those within gaming and entertainment and those who have alignment with education continue to show positive or unchanged guidance

- Those who are more heavily impacted by ad revenue, have travel agency exposure, or are focused on mobility have uncertainty around their business models today, particularly in terms of when and to what degree they can come back

Offense or Defense? Let’s Talk Fundraising.

This discussion stemmed from a great question from one of our Circle members:

“When looking at the future outbreak bubbles forecasted, how are you thinking about the market impact of these potential outbreaks? In other words, how should companies think about IPO/Fundraise timing given the market uncertainty around Q1 2021?”

Today the IPO market is open. Morgan Stanley has two IPOs out and they’re doing very well on the virtual roadshow. That said, future outbreaks are a fair concern. The market may have come back too fast, and there could be a correction that is much, much bigger and much, much longer. This is certainly something to keep in mind when considering fundraising, whether in the public or private markets.

If you’re looking to be offensive, one path to consider is a non-deal road-shows. Whether it’s six months before IPO, 12 months, or even 18 months, it can be helpful to show the institutional side of how the business is evolving. Obviously the main reason is also to build that relationship and have the ongoing dialogue, which you can never start that too early.

These institutional investors are more willing to do these meetings than ever… because they have the time. Taking a half a day and doing five or six meetings with some institutional investors could really yield some really good feedback.

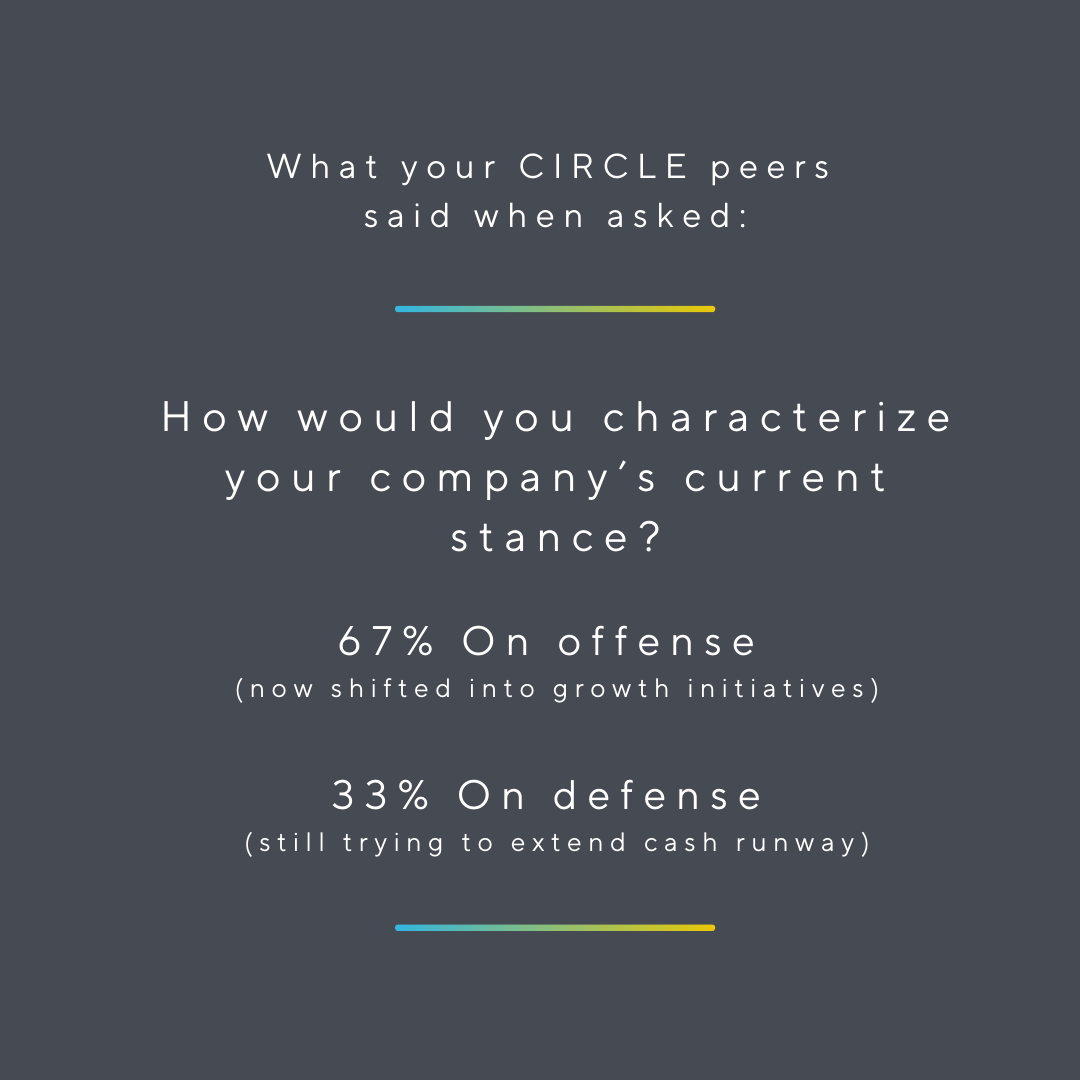

Offense or Defense? Let’s Talk Operations.

As our peer survey reflects, many are shifting from defense to offense. This makes sense given customer acquisition costs are, for many, reaching all-time lows. Many signs point to this being a great time to invest in growth, which begs the question of whether that correlates with public market players.

As our peer survey reflects, many are shifting from defense to offense. This makes sense given customer acquisition costs are, for many, reaching all-time lows. Many signs point to this being a great time to invest in growth, which begs the question of whether that correlates with public market players.

In the public arena, investors are valuing based on growth and profitability. At the beginning of COVID, those lines definitely converged, and profitability gained in relative importance. However, as the market stabilized, they have diverged again, and now growth is much more highly valued. So, what is the takeaway from this?

There is no uniform answer as it heavily depends on what your liquidity position is. That said, the cost to acquire customers and the cost to build TAM at this point is probably better than ever. And so, whatever metric you’re solving for, whether it’s payback period, whether it’s LTV to CAC, whether it’s your return on your actual capital, I would think that it’s a great opportunity. Look to your shareholder base and your board and think about what the longterm objective of the company is to inform the decision to go on the offensive.

This discussion evolved from another set of questions from our Circle members:

“How is the market reacting to experiments with new lines of business, and are many companies doing this at the moment? Can failures in launching new lines of business be written off as COVID-related? Or are investors wanting Companies to focus on their core strengths?”

Investors love revenue diversification. If you’re able to diversify revenue lines, that shows more stability in the business, and that it is more investible. So on the face, investing in new LOBs is great. Where you run into issues is when you’re doing a bet-the-business second revenue line and you’re just temporarily impacted by COVID in your first revenue line. This gets into an excess-risk category that investors will not appreciate.

The questions to ask yourself are:

- Are you able to explore new potentials, and then invest in them after finding that they work?

- Do you have data that can demonstrate the new business has a strong ROI?

- Is the new business line parallel to the core business? This will impact how investors value it

- Can this new business become meaningful?

- If you can show a clear line of sight to 5-10% of total revenue, that becomes somewhat meaningful. North of that, you got to start thinking about segmentation, and how the new business line’s P&L may differ from

Facebook is a great example of how to do this successfully. It’s done an exceptional job over the years of trying new things, stopping when they don’t work, retrying again, and introducing new things.

Those who are able to act quicker and adapt will become the best consumer companies, so this is a great litmus test of that flexibility.

“What About Channel Diversification?”

One category that’s seen a lot of this is eCommerce. The best have diversified their businesses by looking at advertising as opposed to just commerce. You’re seeing a number of companies look at what type of revenue you can get by just the sheer scale and volume of what’s going across your network.

Amazon, Walmart, Instacart, and others have built big businesses around monetizing their traffic. Investing in those types of initiatives, whether it’s through teams or effectively bringing some of those functions in-house can lead to not only a better P&L that’s more diversified but also helps the overall core business.

Especially at a time where direct-to-consumer contact is becoming harder and harder, the more touch-points you can have with the consumer in a more direct way that feels more personalized, the better. This makes investing in new channels are a worthwhile consideration.

Offense or Defense? Let’s Talk Mergers & Acquisitions.

Frequent dialogue with all the large-cap names, Amazon, Facebook, Google, and the likes points to M&A being open for business. Those names have got their wishlists back and their M&A and Corp Dev teams are back to work, so expect to see more strategic discussions and deals, beyond those that have already happened (Facebook / GIPHY, Amazon / Zoox, etc).

For private-to-private M&A and private MOEs, those conversations are increasing dramatically as scale is key in the COVID world. For these transactions, you must carefully consider how to combine the two companies’ cultures, and how you can be more competitive when you emerge as a new combined company. Another challenge is that there aren’t many precedent transactions to refer to in terms of private-to-private internet transactions.

In the private equity world, they’re looking for new deals but with more structure than pre-COVID. These terms come in the form of higher liquidation preferences and guaranteed return hurdle rates that need to be crossed. Given the shift in negotiating power, it’s important to run a competitive process to ensure the terms are truly market.

Related Blog Posts

Five Guiding Principles of an Effective IR Strategy

Communicating and Aligning Expectations With Your Board Ahead of an IPO